As investors, the hardest thing to do is have the courage to bet against the crowd…

Especially when the hype-squad is getting the greed glands pumping FOMO for whatever the new “hot” meme is – be it SPACs, NFTs, or whatever new fad is supposedly going to make you insta-rich.

But if you want to “beat the market,” it usually means being both contrarian – i.e. going against popular opinion – and right!

That’s why today, we’re going to take a look under the hood at the $434 billion per year “back pain epidemic” pretty much no one is talking about…

How a surprisingly simple technology could completely change the options available to 266 million people each year who develop degenerative spine disease…

And how savvy investors can sneak in the “back door” of the growing Mega-Trend by considering a little-known sector expected to hit $14 billion by 2026.

But first…

A Brief History of Back Pain

Back pain isn’t a new phenomenon. In fact, the earliest recorded mention was written on a papyrus scroll dating back to 1,500 BC.

However, since the 1950’s, the Western world has experienced a marked and documented increase in low back disability.

According to The Lancet – one of the world’s oldest and best-known general medical journals:

Low back pain is now the leading cause of disability worldwide.

The European Spine Journal estimated that in 2015, over half a billion people worldwide had low back pain.

It also ranked low back and neck pain as the fourth leading cause of disability-adjusted life years (DALYs) globally – just after ischemic heart disease, cerebrovascular disease, and lower respiratory infection.

What is behind this global “back pain epidemic”?

According to the non-profit Nordic Orthopedic Federation concluded:

“Low back disability, in the sense that we mean it today, is a product of our industrial society.”

As counterintuitive as this might sound… the shift from an industrialized nation with practically non-existent labor laws to a “white collar” economy is perhaps to blame.

Many of us now get to sit in comfortable office chairs for hours a day… and plenty more hours hunched over staring at one of our many electronic devices.

Our spines have not evolved to survive the wear and tear of upright activities.

And even though we’ve had more than 70 years of progress since the end of World War II, the “back pain epidemic” is showing no signs of slowing down – and it’s costing American’s hundreds of billions of dollars each year.

According to Spine – the leading subspecialty journal for the treatment of spinal disorders…

Approximately $90 billion is spent on the diagnosis and management of low back pain, and an additional $10 to $20 billion is attributed to economic losses in productivity each year.

Others have found even more dire consequences…

Total losses from back pain could be as high as 2% of GDP for Western countries, mostly from lost productivity.

With US GDP standing at $21.73 trillion in 2019, that means losses could reach a staggering $434 billion.

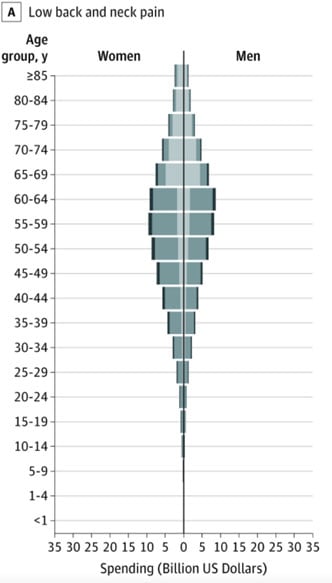

Even discounting productivity losses, the amount of direct healthcare spending itself is eye-opening.

According to a 2016 study of 154 medical conditions, low back and neck pain had the highest amount of healthcare spending – at $134.5 billion.

Hospital costs have been increasing, with one study finding a 177% increase in aggregate costs from 2004 to 2015 for spinal fusion surgeries. Average cost per admission? Over $50,000.

This is a big, expensive problem. And by all indications, it’s only going to get worse.

The Demographic Time Bomb

Studies have found that those over 50 have a 90% chance of some sort of spinal disc degeneration.

That’s why it’s no surprise to learn that spinal fusion surgery was the fifth most popular surgical procedure for the 65 to 79 age group.

Also unsurprisingly, people who go through surgery account for 30 times more costs than those who don’t.

And to make things worse, by 2030, 73 million baby boomers – one in five Americans – will be 65 or older.

This means the increase in spinal surgeries from this “demographic time bomb” will further strain our overburdened healthcare system.

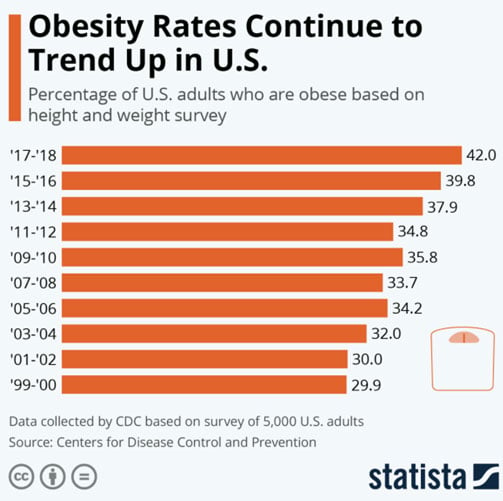

The cherry on top? Our rising obesity rate.

Studies have consistently shown that being overweight or obese are risk factors for low back pain in both men and women.

All these point to a surge in the number of spinal surgeries in the coming years…

And with it, increased demand for spinal surgical technologies.

The number of spinal surgeries per 100,000 adults have risen from 60.4 in 2004 to 79.8 in 2015. For those over 65, the increase was from 98.3 to 170.3.

In the US alone, it’s estimated that surgeons perform 400,000 instrumented spinal fusions every single year!

It’s no wonder why analysts are predicting the global spinal fusion device market – worth $6.37 billion in 2018 – will hit $13.85 billion by 2026.

And this growth is happening despite the painful consequences that occur with failed back surgeries.

For patients considering minimally invasive spinal surgery, the failure rate is uncomfortably high:

- A 25% to 35% chance of failing to achieve “spinal fusion.” When this happens, the most common result for the patient is equal – or greater – levels of pain than before… plus the likelihood of additional surgeries

- A 10% to 40% chance of being diagnosed with Failed Back Surgery Syndrome (FBSS). Even if spinal fusion is successful, it doesn’t guarantee a reduction in pain. In some cases, it could actually make existing pain worse, or create new pain that wasn’t there before.

- An increased likelihood of subsequently developing an opioid addiction. More than one fifth of patients with opioid addiction were associated with FBSS

And also highlights the opportunity for procedures that reduce the surgical suffering of “open” operations.

According to the CDC…

“Over 20.4% of US adults were suffering from chronic pain and 8.0% of the US adults had high-impact chronic pain in 2016.

This is expected to augment the demand for spine fusion implants in the US during the forecast period ”

Add our rapidly aging populace to the mix, and we have a recipe for an almost inevitable increase in spinal surgeries.

The Courage to Be Contrarian

To bring us back full circle, the key to generating market beating returns is to be contrarian and right.

When it comes to investing in healthcare, I hear about futuristic solutions – like AI, robotics, and digital transformation – all the time.

But what I pretty much never hear about?

Simple technologies that lower costs, reduce risk, are easier to use, and have proven results!

A contrarian idea in the face of the dream of “high tech” medicine.

Sincerely,

Jake Hoffberg – Publisher

Equifund