In the rugged terrains of Nevada lies a glimmering treasure that has captivated miners and investors alike for over 150 years: gold.

With global prospects for discovering new mineral deposits becoming increasingly complex, Nevada stands out as an emerging opportunity for American investors.

By marrying traditional wisdom with innovative exploration techniques, the state’s producers and explorers are continually reimagining ways to tap into its vast gold reserves.

Furthermore, the resilience shown by Nevada’s mining industry during the pandemic underlines its strategic importance and potential for sustained growth.

In this article, we will delve into the world of Nevada gold mining, unraveling its rich history, market dynamics, leading players, and exploring why this desert state continues to shine as a golden opportunity in the world of precious metals.

Key Takeaways:

- Nevada Mining Industry: Nevada is the 4th largest gold producer in the world and a $9 billion industry that represents 6% of the state’s GDP.

- Nevada Gold Mining History: Historical mining production began in Nevada over 150 years ago with the discovery of the famous Comstock Lode in the 1850s – one of the richest silver mines ever found to date.

- The Largest Nevada Gold Miner: Nevada Gold Mines is now the world’s single-largest gold producer, with an output of more than four million ounces in 2018, and an estimated 48 million ounces of reserves.

- Nevada Geology: Between 1835 and 2018, three main geological formations – known as “trends” – have produced a combined 170 million ounces of gold: the Carlin Trend, the Eureka Trend and the Walker Lane Trend.

- Nevada Minerals: Over 20 minerals besides gold are mined in Nevada, including lithium and vanadium.

- Nevada Gold Mining Employment: The Nevada mining industry supported an average 15,136 direct employees in 2020 with the average yearly pay for mineral industry employees during this time being $104,205.

- Nevada Mining Jurisdiction: Between 2017 – 2021, Nevada has been ranked either 3rd or 1st best mining jurisdiction in the world.

- Nevada ESG-Friendliness: Nevada also has what’s called the Abandoned Mine Lands (AML) program to address the physical hazards represented by historical legacy gold mines across the state.

How Much Gold Is There In Nevada?

Thanks to the California gold rush of 1848, California earned the nickname “The El Dorado State” – which translates as “the Golden One.”

In 1968, The state of California’s legislative body made “The Golden State” an official nickname based on the state’s long association with gold.

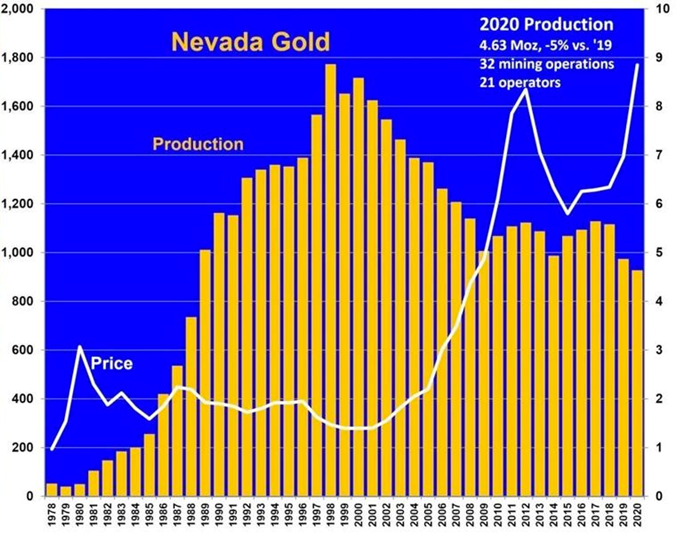

However, the real “Golden State” in America – based on gold production – is the State of Nevada; Nevada led the nation with 4,632,690 oz in 2020 – 74% of the United State’s total output.

Nevada gold production compared to the spot price of gold. Source

According to the United States Geological Survey (USGS), this means Nevada is the 4th largest gold producer in the world behind China, Australia, and Russia, and represents 4.4% of the world’s production.

Furthermore, the USGS data shows Nevada has proven and probable gold reserves in excess of 54 million ounces; At ~$1,900/oz, this represents $102.6 billion in gold.

At the time of publishing, the single largest gold mine in the world is located in the State of Nevada.

The world’s biggest gold mines by country. Source: Statista

When Was Gold First Discovered in Nevada?

Although this represents only a tiny portion of the global gold reserves, Nevada’s natural resources quite literally made Nevada the state it is today.

Historical mining production began in Nevada over 150 years ago with the discovery of the famous Comstock Lode in the 1850s – one of the richest silver mines ever found to date. Thanks to the many silver discoveries in the 19th century, Nevada became known as the “Silver State.”

These silver mines also produced considerable amounts of gold. And over time these deposits helped Nevada become one of the world’s top gold mining regions.

How Big is the Nevada Gold Mining Industry?

Today, Nevada Mining is a $9 billion industry that represents 6% of the state’s GDP, providing more than 80,000 jobs in 2020 (direct and supporting employees). Mining is Nevada’s second-most important industry (after gambling).

Who Are The Largest Nevada Gold Mining Companies?

In March 2019, after decades of fierce competition in Nevada, the two largest gold mining companies – Barrick and Newmont – shocked the gold industry when they announced the formation of a jointly owned company: Nevada Gold Mines (NGM).

The two gold mining companies combined most of their Nevada gold mines and water rights into a joint venture; It’s estimated to produce $500 million in average annual pre-tax synergies in the first five years of operations. Over a 20-year period, Nevada Gold Mines is projected to capture a total $5 billion pre-tax net present value.

Nevada Gold Mines is now the world’s single-largest gold producer, with an output of more than four million ounces in 2018, and an estimated 48 million ounces of reserves.

- In 2020, according to filings, Nevada Gold Mines earned $3.8 billion in revenue.

- In 2020, according to state data, Nevada Gold Mines accounted for about 75% of Nevada’s gold production – of which the State of Nevada accounts for ~78% of all US gold and 5% of global production

- In 2020, Nevada Gold Mines spent nearly $1 billion with suppliers in the state, supporting hundreds of businesses, thousands of employees and helping to grow and diversify Nevada’s economy.

- Nevada Gold Mines employs more than 7,000 people — the vast majority of mining workers in the area. In 2020, NGM employees earned $1.1 billion in total compensation, including wages, incentives and benefits.

- In 2021, NGM paid ~$310 million in state taxes.

In the same year, Newcrest entered a joint venture with Imperial Metals to own 70% of the Red Chris copper-gold mine in BC, Canada. Since then, we’ve seen the $10.6 bn Agnico Eagle and Kirkland Lake merger completed in 2022, which created the current third largest gold producer.

In early 2023, Pan American Silver’s approved acquisition of Yamana Gold (which operates mainly in Canada and Latin America) will see Pan American Silver acquire Yamana’s LATAM assets, while Agnico Eagle will acquire the 50% share of the Canadian Malartic gold mine which it didn’t already own.

Where Can Gold Be Found in Nevada?

Nevada contains one of the single richest deposits of gold on the planet.

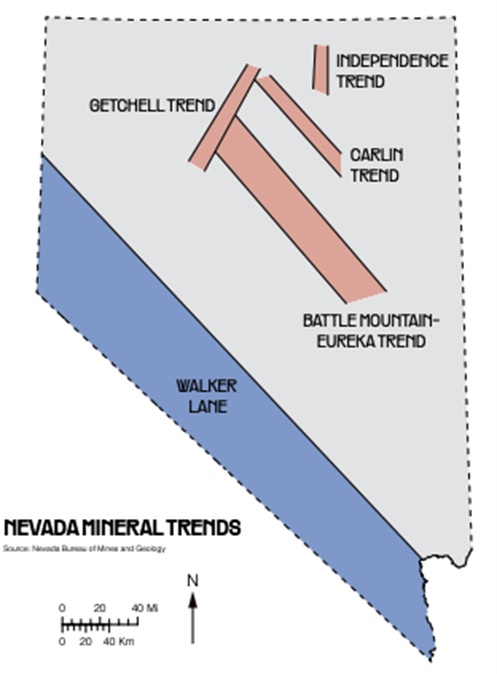

Between 1835 and 2018, three main geological formations – known as “trends” – have produced a combined 170 million ounces of gold in Nevada.

Gold-rich geological trends in Nevada. Source

Carlin Trend

This five-mile-wide, 40-mile-long strip of land has become the world’s third-richest gold-mining district of all time; The trend is on track to produce its 100-millionth troy ounce of gold during 2022, and is estimated to reach 150 million by 2042.

Though Nevada hosts a variety of deposit types, including porphyry and skarn, most of the state’s gold production comes from low-sulfidation epithermal gold and sediment-hosted Carlin-type deposits.

These are large sedimentary rock-hosted disseminated gold deposits which often occur near-surface and in clusters, with one large “elephant” deposit surrounded by a group of smaller satellite deposits with similar geology.

Carlin type deposits are among the largest sources of gold in the world. This precious metal is not visible to the human eye, and is widely deposited making for large, massive low grade gold mines.

In the early 1960’s Newmont honed the technology to extract and process these “invisible” deposits; this turned Nevada into the powerhouse of gold production it is today.

These unique deposits provide 255 M oz of gold (past production and estimated reserves/resources).

Battle Mountain – Eureka Trend

The Battle Mountain – Eureka Trend is located around 50 miles southwest of the famous Carlin Trend. Battle Mountain – Eureka trend has similar geology to its better-known neighbor, and hosts a string of gold and other mineral deposits.

In the last quarter century, Battle Mountain – Eureka has been a prolific and profitable mining site, and some mining experts believe the trend could one day prove to be a more valuable gold deposit than the Carlin trend.

Walker Lane Trend

Walker Lane put Nevada on the gold mining map in 1859, with the discovery of the Comstock Lode, producing 8.5 million ounces of gold and 400 million ounces of silver. This led to the gold rush that eventually increased Nevada’s population enough to earn statehood in 1864.

Unlike the Carlin trend, where most gold mines are producing ore of less than a gram of gold per tonne, Walker Lane stands out with much higher grade gold deposits.

Even though Nevada has undergone several cycles of exploration and development since the mid-1800s, explorers still see potential for more ore to be found, especially at depth.

This can be attributed to the fact that most of the low hanging fruit – the shallow, multi-million-ounce oxide deposits – have been discovered and mined out; new discoveries are coming from deeper deposits that are more difficult to find.

New discoveries, such as Nevada Gold Mine’s recent discovery of the huge 15 million-ounce Goldrush deposit, tend to result from rethinking the geology of previously mined areas and drilling underneath the near surface mineralization.

Therefore, many explorers in Nevada are currently going deeper to find high-grade, refractory deposits. There are also companies focusing in underexplored areas of Nevada in hopes of finding the next major discovery.

According to James Buskard, President and CEO of Nevada Exploration:

“These valley basins have been under-explored due to an historic lack of specialized undercover exploration tools”

A renewed interest in mining – plus new innovations in mining technology – could prove to be a boon to the sector. However, Nevada’s mineral endowment isn’t limited to precious metals…

What Other Resources Are Mined In Nevada?

Besides gold production, over 20 minerals are mined in Nevada, including lithium and vanadium – both of which are essential to the expansion of renewable sources of energy and emerging energy storage technologies – as well as copper, iron, molybdenum, gypsum, limestone, sand and gravel.

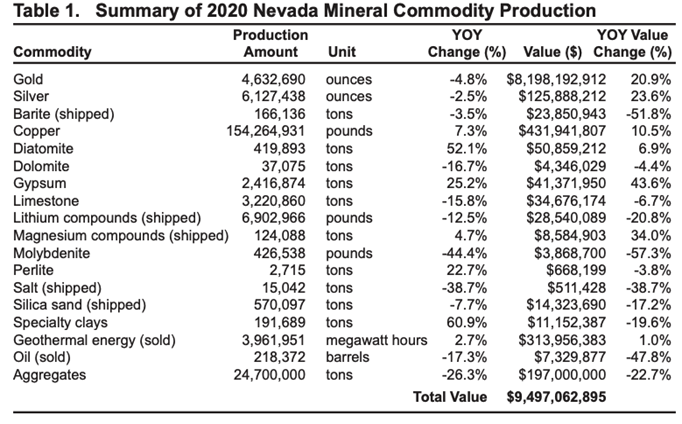

2020 Nevada Mineral Commodity Production. Source: Major Mines of Nevada 2020

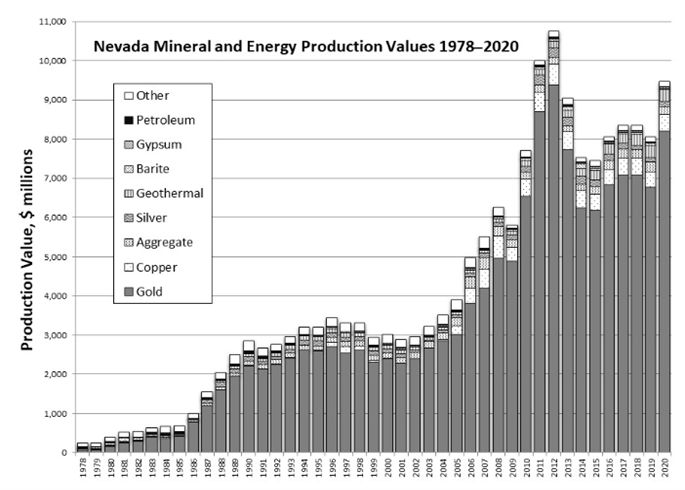

Nevada mineral and energy production values from 1978-2020. Source

According to Rich Nolan, President and CEO of the National Mining Association…

“We are witnessing an exponential increase in the demand for Nevada’s minerals including copper, nickel, gold, silver and lithium as the economy moves towards electrification and with the transformation of our energy sector.

The demand for these minerals will [potentially] boom as the world recovers from the pandemic, infrastructure projects take off, along with the manufacturing of technologically advanced machinery and equipment that rely on these metals.”

Another characteristic that makes Nevada particularly attractive is that there is a large amount of federal land which is open to mineral entry.

In Nevada, the Bureau of Land Management (BLM) is responsible for managing approximately 48 million acres of public lands as well as several hundred thousand acres of “split estate” lands (non-Federal surface estate and Federal subsurface mineral estate).

In total, this means BLM manages ~63% of the state’s 70,264,320 total acres. These lands are managed for a variety of uses, including the production of solid mineral resources. Consequently, a majority of mining and other solid mineral projects permitted in the state involve BLM-managed lands and minerals.

In recent years, we have seen a significant upswing in the number of mining claims attributable to increases in mineral commodity prices, along with a growing recognition of the importance of domestic sources of critical minerals, such as lithium and vanadium.

As of December 1, 2021, there were approximately 235,000 active mining claims on BLM-managed lands in Nevada – a 30% increase over the number of active mining claims on BLM-managed lands in Nevada four years prior.

How Much Money Do Gold Miners In Nevada Make?

The Nevada mining industry supported an average 15,136 direct employees in 2020, with about 75,000 additional jobs related to providing goods and services needed for gold production.

The average yearly pay for mineral industry employees during this time was $104,205 – the third highest average private employment sector in the state.

The state also hosts one of the foremost mining schools in the world; The University of Nevada’s Mackay School of Earth Sciences and Engineering, based in Reno.

However, mining – like many industries – is facing a looming labor shortage as the older generation of workers begins to age out of the workforce. In response, the industry has launched recent initiatives to help recruit new workers.

According to Nevada Mining Association President Tyre Gray:

“In 2022, my agenda is very clear. I call it the two D program. Number one is … to demystify.

When you go to a mine site, you see drones, you see autonomous vehicles, you see sophisticated mapping systems. And so we have to demystify that for people so that Americans, and Nevadans in particular, are comfortable with having mining activity within the state. So that’s number one.

Number two … has been to diversify the industry. Again, with these types of wonderful, good, American dream jobs, when we look at our diversity numbers, we fall behind other sectors.”

Is Nevada a Good Mining Jurisdiction?

Nevada has well-defined regulatory frameworks and effective coordination between Federal, State and local regulatory bodies with respect to gold production & mining.

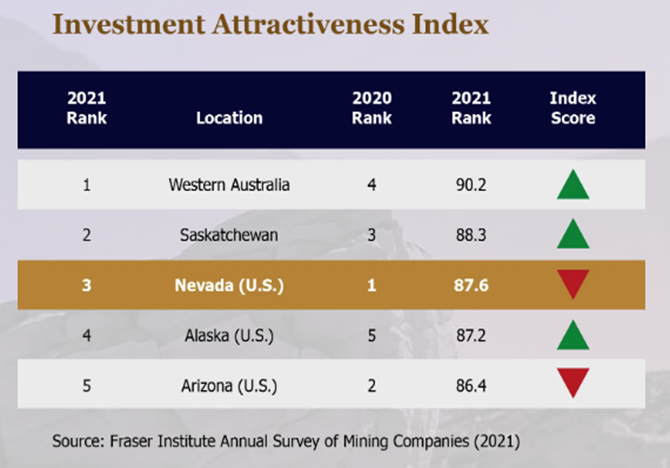

Thanks to this – and the other factors already discussed – the state is a regular top contender in the Fraser Institute’s ranking of the world’s most attractive mining destinations; Between 2017 – 2021, Nevada has been ranked either 3rd or 1st best mining jurisdiction in the world.

Investment Attractiveness Index of various gold mining jurisdictions. Source: Fraser Institute

In recent years, BLM – and other members of the mining industry – have placed greater emphasis on front-loading the various baseline studies and other information collection aspects associated with the environmental review and permitting processes for mining projects.

This approach has been effective in producing project proposals that are more effectively planned, timelier, and more predictable in their permitting processes.

These factors – along with an attractive tax regime with a low net profits tax and no income tax – create a highly desirable jurisdiction for both mining companies and their investors.

Is Nevada Gold Mining ESG-Friendly?

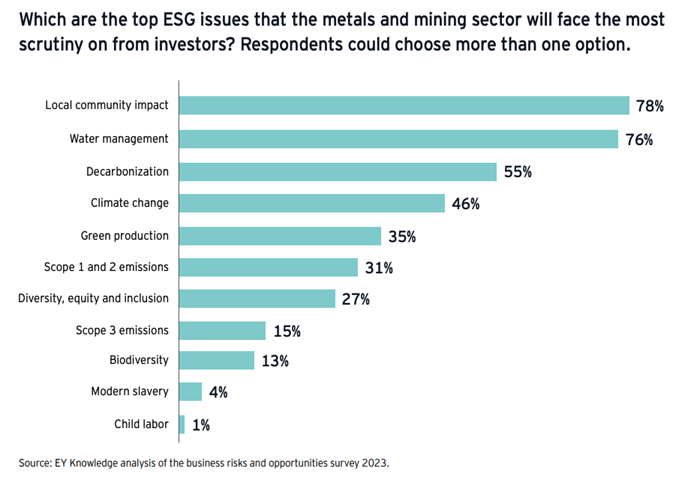

ESG factors are becoming increasingly important for investors, shareholders and a growing group of stakeholders. This means the mining industry must integrate ESG into their strategies, decision-making and reporting.

Thankfully, Nevada has one of the best environmental standards in the world. In 1989, the Nevada legislature approved laws that established a comprehensive regulatory process governing the reclamation of mined and explored lands.

According to Tyre Gray, former president and CEO of Nevada Mining Association (NMA).

“We have a lot of data that shows that mining, at least here in Nevada, is very safe. Even from an environmentalist context, I always tell people [that] if they really care, they want mining to happen in Nevada because of our regulations and how strict they are.

When you offshore that mining into China, Venezuela, Argentina, Ghana, [or] Russia, they are not using the same environmental standards that we are.

And we are one world. The concept that somehow it is okay to dig to mine somewhere else because we don’t see it in a less environmentally friendly way makes very little sense because the downward impact will all be the same.”

The state is also a pioneer in modern environmental standards for mining. A key aspect of this is the reclamation process and the “smart from the start” approach.

According to Mike Visher, administrator at the Nevada Division of Minerals (NDOM)…

“Before any mining or exploration company can initiate any surface disturbance on public lands in the state, they must put forth a financial instrument to cover the total cost needed by a federal or state regulating agency to perform all the required reclamation that would result from their proposed project,”

This requires companies in Nevada to plan not only for the mine life, but also for the mine’s closure, before mining operations commence.

Nevada also has what’s called the Abandoned Mine Lands (AML) program to address the physical hazards represented by historical legacy gold mines across the state.

“The AML program is setting the standard for our country. Part of its success derives from the fact that the funding comes from mining claimants themselves, unlike in many other states,” Visher explained

Not only is Nevada making great efforts to minimize the adverse environmental effects of surface mining and ensuring that mined lands are returned to a beneficial end use… but it is also striving to fix past “mistakes” from the unregulated mining era.

However, despite all this, the state faces the perennial struggle of a strong anti-mining sentiment.

The sector is thus making huge efforts to overcome its negative public perception and to expose people to what modern mining looks like in Nevada.

Conclusion

Nevada’s gold mining industry is a fascinating blend of past and present, uniting the legendary Gold Rush era with the state’s contemporary role as one of the world’s leading producers of gold. From employing thousands in modern mining operations to contributing billions to the economy, Nevada’s golden legacy continues to shine.

With consistent production and an ever-present demand for gold on the global market, investing in promising gold mining stocks can offer a solid hedge against volatility as well as an opportunity for growth.

Want to learn more about investing in gold and private market deals?

Here at Equifund, we help investors access early-stage opportunities not found anywhere else. To view our current listings, go here now.