Are you looking for a new and potentially lucrative way to bet on gold?

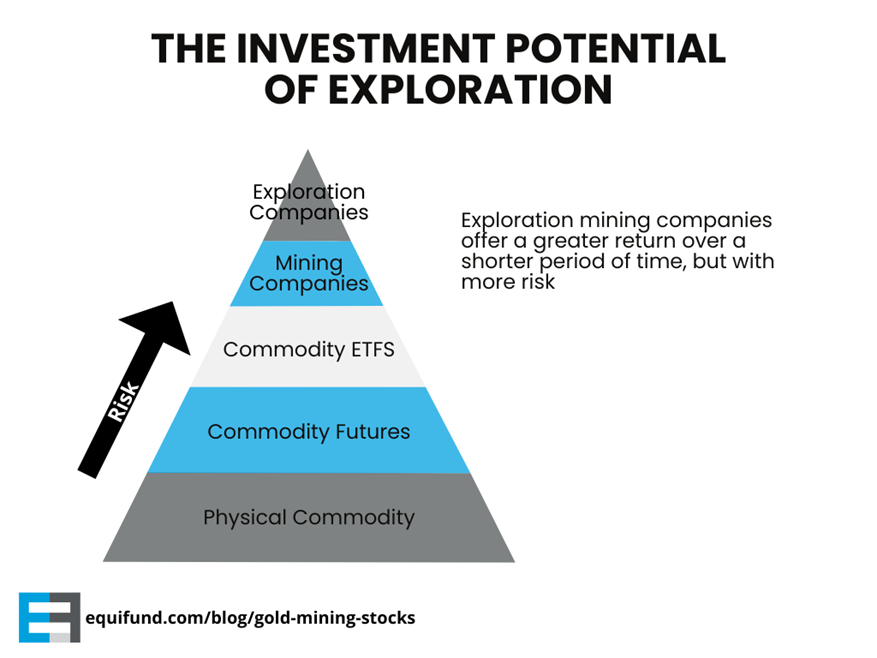

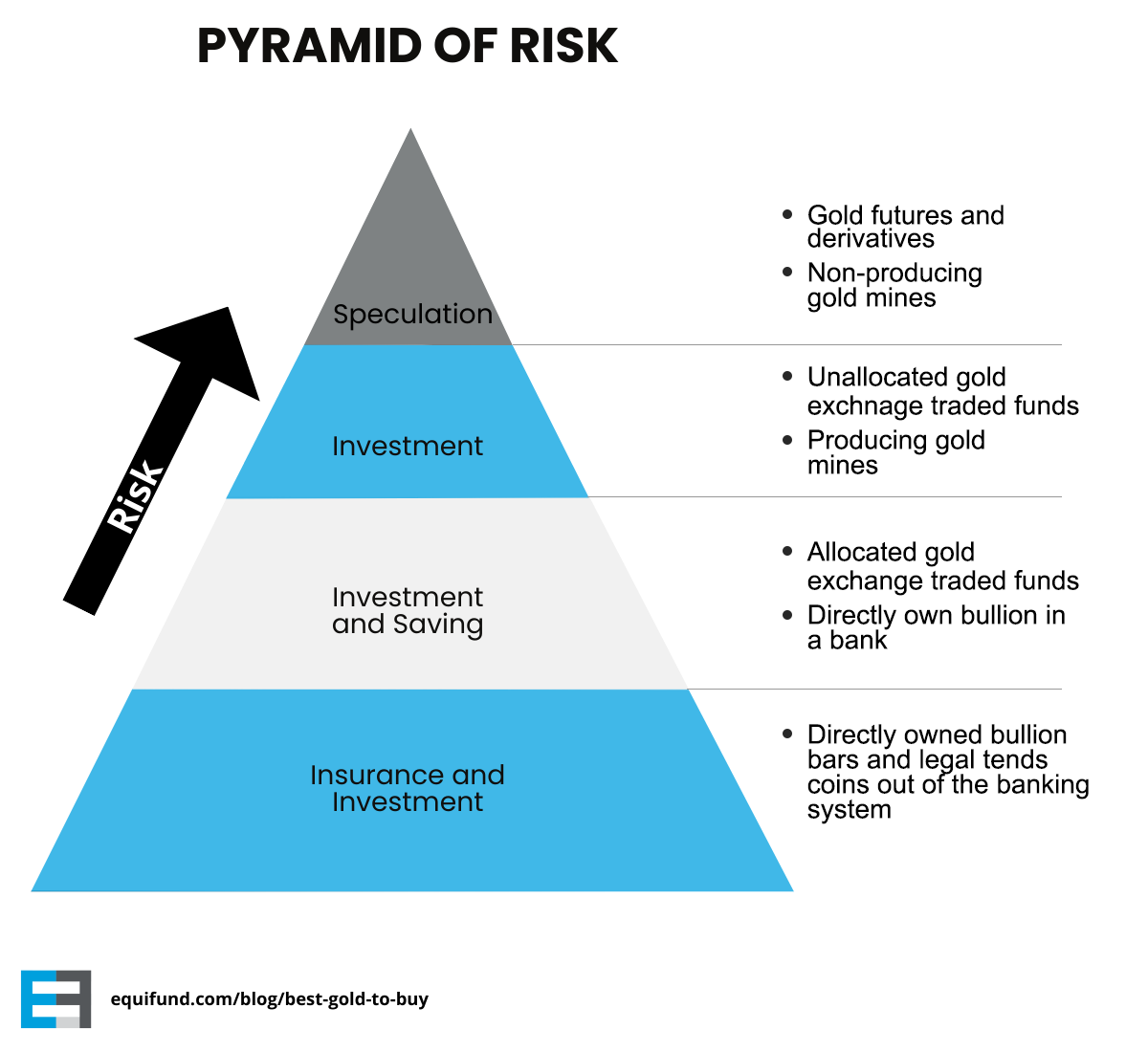

Investing in gold is an age-old strategy for hedging against economic uncertainty and potential inflation. Yet the traditional methods of capitalizing on gold’s value, such as investing in junior mining stocks, futures, or options contracts, often come with risks that are not suitable for every investor.

Physical gold trading can be costly, derivatives can be overly complex, and mining stocks can be exceedingly volatile.

But what if there were a way to invest in gold that may potentially combine the security of physical gold, the stability of real estate’s cash flow, and the growth potential of technology stocks?

Enter the innovative world of Gold Royalty and Streaming (R&S) companies. These companies provide an alternative financing agreement to junior mining companies that guarantee the rights to future cash flows or metals production.

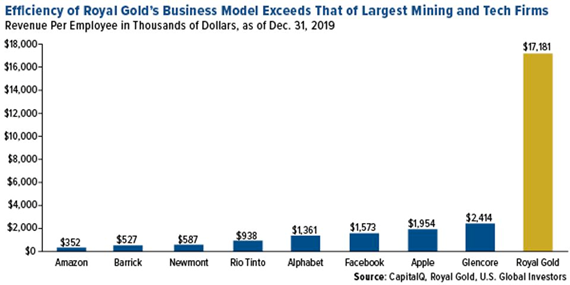

Institutional investors prefer this little known asset class when seeking superior risk-adjusted returns in the gold markets for one simple reason: It’s a business model that generates more revenue per employee than Amazon, Facebook, Apple, and Alphabet… combined!

In this article, we’ll delve into the nuts and bolts of gold R&S, explore the compelling reasons to consider investing in these companies, and highlight some of the most promising R&S players in the market.

Key Takeaways:

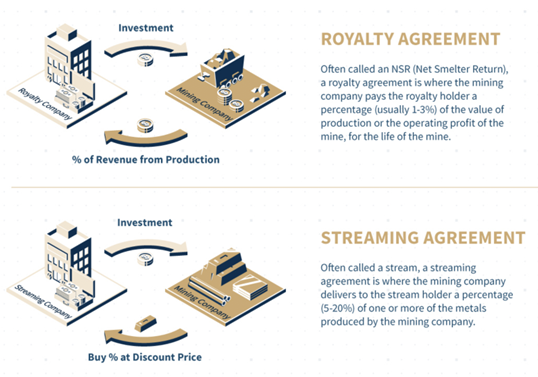

- Gold Royalty: A gold royalty is a financial arrangement in the mining industry that provides the right to a percentage of gold production or revenue from a mining operation.

- Gold Streaming: A precious metal stream is a purchase agreement that provides an upfront capital payment to mine operators and explorers in exchange for a percentage of gold output at a below-market cost.

- Gold Royalty & Streaming Companies: Today, there are approximately 20 R&S companies primarily focused on precious metals— only 6 of which have a market capitalization of over $1 billion.

- Gold Royalty & Streaming Company Valuation: However, because royalty and streaming entities depend on the cash flow that comes from the production and sale of mineral ounces, a discounted cash flow (DCF) is the ideal method for determining valuation.

What is Gold Royalty and Streaming?

Before we dive into Gold Royalty and Streaming (R&S) companies, let’s start by defining what R&S entails.

What is a Gold Royalty?

A gold royalty is a financial arrangement in the mining industry that provides the right to a percentage of gold production or revenue from a mining operation.

Rather than owning a stake in the physical property or the mining company itself, the entity holding the royalty (often a gold royalty company) simply receives a portion of the revenue or production from the mine.

What Does Streaming Mean in Mining?

A precious metal stream is a purchase agreement that provides an upfront capital payment to mine operators and explorers in exchange for a percentage of gold output at a below-market cost.

The capital provided is used for funding exploration work, mine development, construction or expansion… all without incurring dilution to their share structure or debt to their balance sheets.

While royalties are usually applicable for the entire lifetime of the mine, streams often apply only until a prespecified volume of production is delivered. After this threshold is reached, the stream ceases to exist or is modified.

But the most important difference between a royalty contract and a streaming contract is this; Under a streaming contract, the mine is contractually obligated to deliver a defined amount of ounces on a defined schedule… regardless of where the metal comes from.

This means if – for whatever reason – the mine operator cannot produce enough gold to fulfill their obligation… they will have to buy gold at market price in order to deliver it to the R&S company.

In the event they miss their repayment schedule, the penalties can be steep; in some cases, they would be forced to forfeit the entire property for essentially “defaulting” on their contractual obligations!

This means there is an additional layer of downside protection that royalty contracts don’t come with… but still retains a similar speculative upside potential. However, this added protection means that streaming contracts tend to cost substantially more than royalty contracts.

What are Gold Royalty and Streaming companies?

These firms create shareholder value by offering an alternative financing agreement to junior mining companies that guarantee the rights to future cash flows (gold royalty companies) or metals production (gold streaming companies).

But what’s in it for mine operators and explorers? Mining, particularly in the exploration and development stages, is an extraordinarily high-risk venture, often making it difficult for junior mining companies to secure traditional financing.

Exploration companies are the most high risk play in gold investment.

The initial phase of finding a workable mineral asset is fraught with uncertainty. Geological studies can be inconclusive, and the process of drilling and testing to determine the viability of a mineral deposit can be both costly and time-consuming. Even when a promising site is located, there’s no guarantee that it can be mined profitably, considering factors like ore quality, location, regulatory hurdles, and fluctuating market prices for the minerals.

The risks continue even after a viable deposit is identified. Developing a mine requires a substantial financial investment in infrastructure, equipment, and personnel. Environmental regulations can impose additional challenges and costs, and the actual process of extracting the minerals is complex and often subject to unexpected complications. Delays, cost overruns, and technical challenges are common, and the time from discovery to production can be several years.

Because of this risk profile – along with a general dislike for mining companies in capital markets – there are limited financing opportunities for junior mining companies.

That’s exactly why alternative financing agreements – like royalty & streaming contracts – provide a “win-win” solution for junior mining companies and investors.

In exchange for a non-dilutive source of capital today, the mining company agrees to give investors a long-term, annuity-like repayment with two forms of downside protection… and a small chance at exponential upside.

Why Invest in Gold Royalty and Streaming Companies

Gold Royalty and Streaming creates a compelling value proposition for shareholders in the current macroeconomic environment, including downside protection, cash flows, and significant growth potential.

To be clear, all investments carry some sort of risk. Royalty & streaming contracts are not a sure thing and there is potential for the loss of some or all of the principal invested.

However, R&S is a beautiful low-cost setup that – coupled with a diverse portfolio of revenue generating assets – is a large part of the reason why the R&S business model has been so successful. Here are some of the top reasons why investors are buying into Gold Royalty and Streaming companies.

Cash Flow

As long as the mine is producing, investors are entitled to a portion of either the revenue generated by the company (a royalty), or the actual metal production at a discounted gold price (a stream).

Generally speaking, royalties are created when a junior explorer needs money to continue exploring his land package. Streams are created when a mine developer needs to raise capital to build a mine. Source

This revenue generating, low overhead type business model even allows R&S companies to potentially provide a dividend distribution to its shareholders.

Downside Protection

It doesn’t matter if the mining company runs out of money and crushes equity and debt holders. R&S Contracts cannot be discharged in bankruptcy. It is attached to the property until all the conditions in the contract have been met.

This also means that if the property is ever sold to another mining company and brought into production… The R&S contract stays attached and investors still get paid.

In fact, it doesn’t matter if any gold is ever produced from the property. Investors can still potentially get paid!

Scalability

The Royalty and Streaming business model provides the ability to diversify over many royalties, achieve high profit margins (80%+), incur no ongoing capital requirements or exploration costs (but do get exploration upside).

Since these firms operate as non-bank lenders to gold exploration projects, their ability to scale is only limited by the amount of viable opportunities and the cost of capital.

Leveraged Exposure

For investors, R&S companies provide commodity-price leverage – known as “Embedded Optionality” – and exposure to the underlying commodities and price movements.

- This means if gold prices go up, profits could go parabolic.

Royalty companies compared to other investment vehicles. Source

Not only would each ounce of gold produced be worth more, it could potentially bring reserves into play that weren’t profitable to mine at lower gold prices… further increasing the value of the R&S contract in place.

According to David Cole, CEO of EMX Royalty Corporation

“[Royalty & streaming contracts] are fantastic financial instruments because of that embedded optionality, commodity optionality, price optionality… but more important is discovery optionality.

Other types of optionality people don’t think about is the establishment of more infrastructure, cheaper electricity, advancement of metallurgical technologies, engineering technologies.

All of which are to the benefit of the [investor] because it increases the resources in the ground, increases the reserve, increases production over time, at no cost to the royalty holder.

Historical Performance

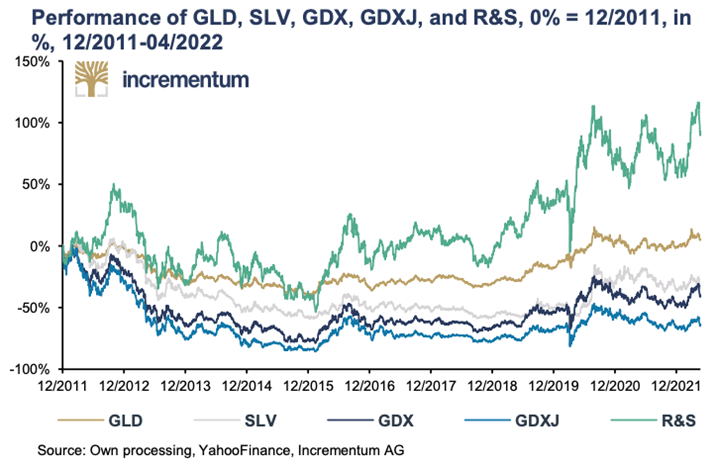

Take a look at how precious metals royalty and streaming companies performed after gold and silver peaked (and then collapsed) in late 2011.

Performance of various precious metals royalty and streaming companies. Source: Incrementum

Even when precious metals were down in the dumps, royalty and streaming companies stayed in good shape, thanks to their lean and efficient business model.

Why? It all has to do with the way R&S contracts are structured. Unlike an options contract that gives holders the right to purchase an asset at a specified price for a specified duration of time, but can also expire worthless…

Royalty & streaming contracts are valued relative to the reserve and resource reports on the property and its potential future cash flows.

This means that aside from instances of fraud – or the price of gold dropping so low that the property is unprofitable to mine (known as “impairment”) – the R&S contract will likely retain value.

For this reason, there have been substantial rewards to getting in early on a high-growth royalty company; Some of today’s most successful companies started out with a very low stock price/market cap but were able to successfully (and quickly) scale the business.

Sandstorm Gold (SAND) was a huge winner with nearly 700% gains from 2009 to 2013, as well as larger streaming/royalty peers Franco-Nevada (FNV) and Royal Gold (RGLD) as several of these companies saw their stock price increase by 20X or more in just 2-3 years’ time.

While rising gold prices contributed to these gains, these companies have greatly outperformed the typical mining company as they created more value with less dilution to shareholders.

How Do You Value Gold Royalty and Streaming Companies?

When it comes to valuing R&S companies, it requires a different approach than valuing mining companies using P/NAV (Net Asset Value).

Exploration and development companies find their value from the assets / ounces they can prove; for these reasons, the P/NAV is used to determine the fair market value (FMV) of the company.

However, because royalty and streaming entities depend on the cash flow that comes from the production and sale of mineral ounces, a discounted cash flow (DCF) is the ideal method for determining valuation.

The key factors for calculating the DCF are;

- How many ounces are in the resources and reserves report?

- How long will it take to get the asset into production (which, in turn, creates cash flow)?

- What is the estimated profit per ounce mined (i.e. the spot price of gold minus the operating costs to extract it)?

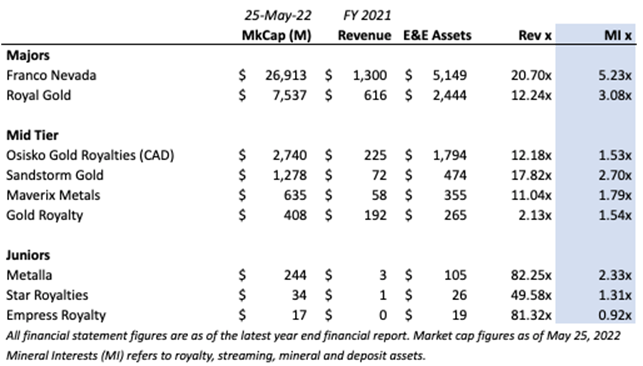

For these reasons, we believe the most useful way to understand valuations is based on current exploration and evaluation (E&E) assets.

Similar to other industries, as the company matures, investors are willing to assign higher multiples as the certainty of future cash flows increases.

Valuation multiples of various R&S companies

The majors are valued at a 3x – 5.23x multiple; Mid tier producers seem to trade in the 1.5x-2.5x range; Juniors seem to trade in the 1-2x range (with the exception of Metalla, which currently trades at 2.3x multiple).

This means investors in early stage R&S companies have the opportunity to “get paid twice” as the company grows in scale and its stock is “re-rated” at a higher multiple.

Examples of Gold Royalty and Streaming Companies

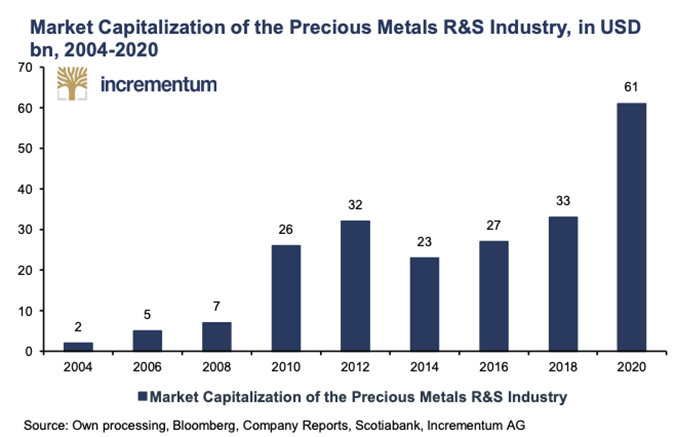

Over time, numerous new precious metals-focused R&S companies emerged. The overall market capitalization of the industry grew as well, from USD 2bn in 2004 to USD 66bn as of April 2022.

Market capitalization of precious metals R&S industry. Source: Incrementum

Today, there are approximately 20 R&S companies primarily focused on precious metals— only 6 of which have a market capitalization of over $1bn:

- Franco-Nevada

- Wheaton Precious Metals

- Royal Gold

- Osisko Gold Royalties

- Triple Flag Precious Metals

- And Sandstorm Gold.

Let’s explore three well-known players in the R&S space.

Franco Nevada (TSE: FNV)

The world’s biggest R&S company, Franco-Nevada (FNV), had only 40 employees as of the end of 2021, while its revenue was nearly $1.3bn. This amounts to $32.4mn per employee.

For comparison, the world’s biggest gold miner, Newmont Corporation, had 14,400 employees and revenues of $12.2bn, or roughly $850,000 per employee.

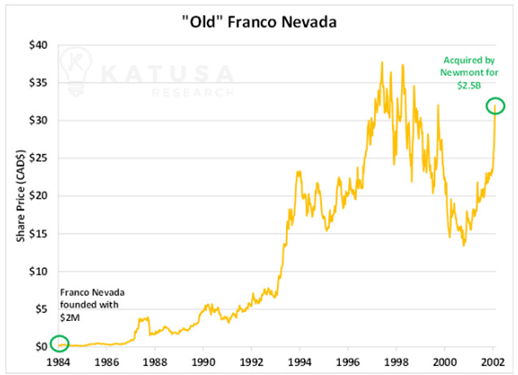

In 1985 when Pierre Lassonde, founder of gold exploration company Franco-Nevada Corporation, made the first ever R&S contract.

Lassonde made a $2m bet – roughly half of the cash in treasury – to acquire a 4% royalty on the Goldstrike mine (which is still in production today).

Today, that single investment has produced $800 million in revenue and is expected to make $1.2 billion in total profits… an astronomical 59,990% return.

Additionally, Franco-Nevada delivered a 15,614% return over 18 years for their shareholders… while gold returned essentially 0% over the same time frame.

“Old” Franco Nevada’s incredible rise from CAD$0.21 per share and a market capitalization of CAD$2 million, to the eventual buy out by Newmont for CAD$2.5 billion at over CAD$33 per share – a 15,614% return in 18 years! Source: Katusa Research

“We grew the company at 36 percent compounded for 19 years in a row. Even Warren Buffet doesn’t have a record of 36 percent per year compounded.”

When asked about the success of Franco-Nevada and its business model, Pierre Lassonde responded:

“We get a free perpetual option on the discoveries made on the land by the operators, and we get a free perpetual option on the price of gold.

It’s the optionality value of the land, the value of the operator spending money on our land, and the optionality to higher gold prices. And that is worth so much money.

When you buy a stream, on the other hand, you get price optionality. You’re buying, say, 100,000 ounces of gold for the next 25 years. So you get optionality on the price of the commodity, but you don’t get much optionality on the land.”

Put another way; They were able to secure an R&S contract on promising properties… got “lucky” on the embedded optionality portion of the play… and leverage that success into more success.

Royal Gold (NASDAQ: RGLD)

Royal Gold Corp (RGLD) is a leading company specializing in the acquisition and management of precious metal streams and royalty interests.

In 2019, Royal Gold generated over $499 million in revenue in with just 29 employees: an unbelievable $17 million in revenue per employee (RPE).

In 2019, Royal Gold generated an unbelievable $17 million in revenue per employee – many times more than some of the world’s largest mining and tech firms generated on a per-employee basis.

Their business model enables them to invest directly in mining assets, strengthen balance sheets, and fund mergers and acquisitions without taking on associated debt obligations. Moreover, RGLD has a commitment to returning capital to shareholders, reflected in their track record of increasing annual dividends since 2000.

Nevada Canyon Gold Corporation (OTC: NGLD)

Nevada Canyon Gold Corporation (NGLD) is a publicly traded Gold Royalty and Streaming company headquartered in Reno, Nevada.

Unlike other royalty and streaming companies that target large producing mines, NGLD believes they have found a viable opportunity to finance smaller properties that are in the production or pre-production stages.

Management indicates they don’t want to own equity positions in mining companies. Instead, the goal is to:

- Acquire Royalty and Streaming (R&S) contracts on the property, entitling NGLD to both a percentage of all future revenue and metal production in perpetuity,

- Gain a controlling interest of the gold resources in the ground, providing management the ability to sell the property on behalf of both parties.

- Expand the reportable resource base and assemble drill-ready land packages for mining companies to explore and develop, then

- Sell the package for short term cash infusions while retaining the R&S assets for long term appreciation.

But NGLD isn’t looking to compete against major players like Franco Nevada, Wheaton Precious Metals, and Royal Gold for these “blue chip” contracts.

According to NGLD management…

”It’s really expensive to buy a fully “de-risked” income stream that comes from a producing mine.

That’s why we are looking to capture the up and coming supply before they become the next blue chip contracts.

Nevada Canyon will focus on acquiring royalties on smaller producing properties, pre-production, exploration or pre-resource properties, creating a royalty package by aggregating them under one roof and selling the consolidated package.”

At first glance, this strategy of targeting smaller properties – and earlier stage properties – has substantially higher risk.

However, for investors looking for an opportunity to generate outsized returns, NGLD’s approach is to look for speculative investments that have misunderstood – and therefore, mispriced – risk factors.

That’s why Nevada Gold Corporation is targeting small properties in the State of Nevada that have:

- Existing resources and reserves,

- Development on the property has happened in the past or is in progress now, and

- Potential to expand resources and reserves by 1 million+ GEOs

Why? Because there are so few competitors, management believes they are in a position to negotiate R&S contracts that could be sold for at least what they paid for them…

And if done correctly, have the potential to generate extraordinary returns in a short period of time. For shareholders in NGLD, it provides an investment vehicle that offers a private-equity-like strategy without the traditional 2% management fee and 20% carried interest.

Want to learn more about investing in gold and private market deals?

Here at Equifund, we help investors access early-stage opportunities not found anywhere else. To view our current listings, go here now.

P.S. Equifund just launched its latest Regulation A+ offering for an already-publicly-traded gold royalty and streaming company.