You’re probably sick and tired of hearing about the de-dollarization narrative, the debt ceiling shakedown, and Janet Yellen’s June 1st “hard deadline,” where we risk a default…

That’s why today, we’re going to talk about the story you probably haven’t heard much about:

Gold – despite recently hitting a new all time high – is still a widely “hated” asset.

But seriously, think about how strange that is.

Can you name a single major asset class – not a specific stock or coin – that has recently hit all time highs?

Spoiler: you can’t because there isn’t one.

How about one that has seen record levels of demand, driven by “colossal central bank purchases, aided by vigorous retail investor buying?”

So why is it that almost no mainstream financial media outlets are talking about gold…

But pretty much everyone is pushing the two seemingly at-odds narratives of “AI is going to usher in a new era of productivity and corporate profits” and “HOLY CRAP RECESSION!”

The Conference Board recently published research putting the chances of a U.S. recession occurring within the next 12 months at a whopping 99%…

And analysts from major banks are all bullish on gold in 2023:

-

Goldman Sachs recently hiked its 12-month gold price target to $2,050 an ounce from $1,950, joining others such as Citi, ANZ, and Commerzbank in raising forecasts.

-

Bank of America has its price target set at $2,100

-

Wells Fargo recently raised its 2023 year-end target range for gold to $2,100 – $2,200 per troy ounce, and established its 2024 year-end target range of $2,400 – $2,500.

That’s why in this issue, we’re going to talk about gold.

Let’s dive in,

-Jake Hoffberg

P.S. We just launched our latest Regulation A+ offering for a gold royalty and streaming company.

As a reminder, securities sold under Reg CF, Reg A, and Reg D are often considered high risk, and speculative in nature. Please do not invest funds you cannot afford to lose, or otherwise need immediate access to.

How The Coming Commodity Supercycle Could Lead to A New Era For Gold

According to Goldman Sachs – and a growing chorus of other analysts – we could be looking at a potential bull market in the original source of all wealth… commodities.

Just as commodity markets were dominated by the dollar in 2022, Goldman Sachs analysts expect them to be shaped by underinvestment in 2023.

That’s why the firm believes we’re about to witness something called a Commodity Supercycle; a “decades-long, above-trend movement in a wide range of base material prices,” caused by a structural change in supply and demand.

Commodity prices – unlike financial markets – perform an economic function of balancing supply and demand. Once high prices have rebalanced the market in the short term, high prices are no longer needed, sending prices downward as we witnessed in late 2022.

However, because the growing demand for base materials will likely outpace our current supply, the law of supply and demand points to one thing: prices must go up!

We’re already beginning to see confirmation of this trend as inflation roars, geopolitical conflicts flare, and rising interest rates put significant pressure on pretty much everything.

In 2022 commodities finished the year as the best-performing asset class with ~20% returns, despite recent price declines as liquidity dries up.

“What do rate hikes do? They raise the cost of capital, and you deleverage. What’s one of the best ways to deleverage? You run your inventories down. Inventories of almost every primary commodity are at critically low levels. People can’t afford to hold it. Part of this [is] fear of recession.”

In practice, this removes a key buffer against fundamental shocks on prices, while raising price volatility and lowering the willingness or ability of investors to get exposure to commodity derivatives—exactly as we saw in March of 2022.

In the wake of the recent regional bank failures, it’s anyone’s guess if liquidity will continue to decrease in commodities, or if capital will come back in.

However, for investors who believe in the Commodity Supercycle thesis, and seek to capture profits, there’s one major question that needs an answer.

What could trigger the next upward movement in commodity prices in 2023 and beyond?

Broadly speaking, we see three logical catalysts that could drive the next wave up in commodity prices: Inflation, the Reopening of China, and Resource Nationalism.

Potential Catalyst #1 – Inflation

Commodities prices tend to fluctuate at a rate that is inversely proportional to the strength of the U.S. dollar, a universal standard for commodity pricing. Due to their inherent value, commodities can be viewed as a hedge against inflation, and they tend to gain value when consumer prices rise.

Potential Catalyst #2 – The Reopening of China

One of the most talked about catalysts for commodities is the reopening of China after nearly three years of “Zero Covid” policy.

According to the Economist: “Increased demand for energy and commodities will [likely] be felt around the world. The great reconnecting of China with the outside world marks the end of an era: that of the global pandemic.”

Goldman Sachs recently stated in a note to clients, “We recommend investors own mining stocks, which are levered to China growth through rising metals prices.”

While analysts are broadly bullish about commodities, metals have one huge – and often mispriced – risk factor that could send prices soaring…

Potential Catalyst #3 – Resource Nationalism

While many investors may see battery metals – like lithium, nickel, and cobalt – as the most exciting growth opportunity of the decade, these metals are increasingly being seen as “critical minerals,” and face the threat of resource nationalism; a move that could shut out foreign investors from these opportunities entirely.

We’re already seeing this happen. In April, Chile’s President Gabriel Boric announced he would nationalize the country’s lithium industry.

The shocking move, in the country with the world’s largest lithium reserves, would eventually transfer control of Chile’s vast lithium operations from industry giants Sociedad Química y Minera de Chile (NYSE: SQM) and Albemarle Corp (NYSE: ALB) to a separate state-owned company.

This is a huge problem for America, which has underinvested in mining and process capacity for years, and is forced to import a significant amount of these critical resources from increasingly hostile nations such as China and Russia

However, what we lack in battery metals, we make up for in one of the world’s most valuable metals, and one that can be converted into any currency at a moment’s notice.

A metal that has historically been the inflation hedge of choice for investors around the world, many of whom are underweight in their asset allocation models: Gold!

Today, the world’s largest funds have a ~3% allocation towards commodities. Of that, ~5% is allocated towards gold.

And now, according to a recent poll by Gallup, for the first time since 2013, Americans think gold is a better long term investment than stocks and mutual funds.

And if you believe like I do that:

-

Inflation is inevitable…

-

The Commodity Supercycle will create a structural change in demand for commodities (including gold)…

-

Geopolitical conflict will continue to cause dramatic changes in supply chains…

-

Investors everywhere will continue to see gold as the defensive asset of choice…

The only question remaining is this: Is there enough supply to meet demand?

The ~$14.73 TRILLION Global Gold Market

The best estimates currently available suggest that around 208,874 tons (or aprox 7,365,882,077 ounces) of gold have been mined throughout history, of which around two-thirds has been mined since 1950.

Assuming ~$2,000 gold, this equals roughly $14,731,764,155,920 in above-ground value.

Regardless of your personal views on gold – a proven store of value or a silly shiny metal – the economic case for gold is simple: there’s currently more demand than supply.

An annual 500 metric-ton shortfall is unsustainable, and will likely put upward pressure on gold prices for the foreseeable future. (Statista)

According to Economics 101, when demand is greater than supply, the price will go up, or a substitute will be used.

However, for many investors, there is simply “no gold like gold” and no substitute is accepted.

From 2011 – 2021, the U.S. was a net exporter of gold (with the exception of 2020). However, every year we mine less gold. In 2021, domestic gold mine production was estimated to be 180 tons, 7% less than that of 2020.

These looming shortages could one day threaten the economic security of the United States.

It’s called the “Gold Supply Cliff”… and this growing supply and demand imbalance is putting serious pressure on the world’s top gold mining companies.

The “Gold Supply Cliff” is an industry term for the dwindling amounts of gold it is possible to mine profitably – even at higher gold prices

How did this happen?

As a business model, most majors like to let junior mining companies take all the risk of finding new deposits. Then, once the juniors have struck gold, they’ll buy the reserves and develop the mine.

When new deposits are being found, the “growth through acquisitions” model works well. However, for the past 20 years, explorers have failed to find a single deposit above 30 million troy ounces.

Over the previous three years, there have been zero gold discoveries above 2 million troy ounces.

And the markets are noticing. The price of gold climbed from its January 2016 low of $1,064/oz to a new all-time high of $2,035 in August 2020. However, despite this increase, exploration budgets have steadily decreased since 2012.

Why? After crashing from 2011 highs to a 2013 low of $1,180, it was too expensive to explore for new deposits. Instead, they focused on mining existing deposits.

Many mining companies – who were overleveraged with bloated cost structures – were forced into dramatic cost-cutting, paying down debt, and often the firing of exploration teams.

As gold prices soared in 2020, major gold producers accelerated production of existing resources, taking advantage of higher prices…

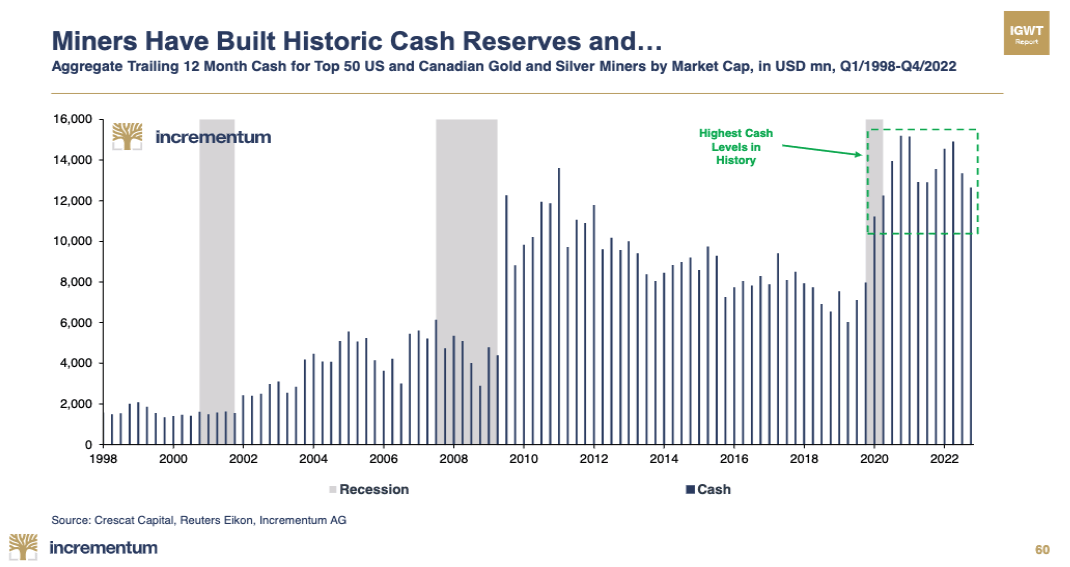

Today, gold miners are seeing record cash flows and cash reserves.

Precious metals producers are printing money at a fever pace. You can see that for a decade straight, the industry was a black hole for capital. Now, the sector has strung together multiple massive quarters and bolstered battered balance sheets. (Marin Katusa)

The tradeoff? Miners are exhausting their existing reserves and resources.

The small number of mines that can generate more than 10 million troy ounces – known as world-class deposits – are running dry. Because of this large imbalance of “gold demand” vs “gold supply,” experts and analysts are sounding the alarm…

The world is running out of new gold!

After a decade of disappointing price action in gold markets, investors are starting to pile back into the yellow metal, and prices are rising.

According to S&P Global Market Intelligence (S&P), global exploration budgets rose 16% in 2022, following a 34% rebound in 2021. S&P added that while allocations for most commodities increased in 2022, budgets for gold and copper posted the largest dollar increases, while energy transition efforts saw lithium increase to its highest total ever.

Now, after one of the most aggressive rate hikes in history, we’re already seeing the markets crack under pressure…

And the hotly debated “Will The Fed Pivot?” seems to be increasingly priced into analyst assumptions (and is largely regarded as a bullish sign for gold prices).

But the bullish case for gold comes with a simple question for all investors…

What has to happen for the market to confirm the trend, and capture investor interest in 2023?

For investors seeking to capture outsized returns, the commonly cited Reid Hoffman quote about “being contrarian and right,” is only half the story.

If you plan on exiting your positions for more than your cost basis, at some point, the market has to agree with your thesis and price the asset higher.

For over a decade, we’ve seen chronic underinvestment in the resources sector, in favor of technology. To buy mining stocks in favor of tech stocks was – to some degree – the ultimate contrarian bet.

However, because gold prices are more influenced by sentiment than industrial usage (compared to silver, platinum, and palladium), something needs to happen for the gold narrative to “cross the chasm” into the mainstream, and enter into a persistent upward trend.

The main focus in 2023 is whether a new capex cycle will begin, which depends on attracting capital through better relative returns. The drop in new economy valuations and rising commodity prices are moving capital towards commodities, energy, and industrial firms.

A three-year track record is crucial for persistent capex, as management needs investor rewards for expansion plans.

In the last cycle (2011-2020), US E&P’s destroyed $0.54 for every dollar invested, while battery metal producers, not exposed to prior supercycles, enjoy[ed] investor confidence. The return of capex will drive the next leg higher, but only sustainable higher returns in 2023 can confirm this.

As we’ve already discussed, gold miners have seen record cash flows and cash reserves over the previous two years. Another solid year of performance in 2023 could help anchor the bullish narrative for gold, driving investor sentiment and fund flows.

Macro factors signal we are likely in a late-cycle economic environment, with persistently high inflation across the global economy. When economic expansions are close to their peak, gold prices often increase.

Gold’s biggest gains typically occur in the final stages of expansions, because gold’s long-term price dynamics are cyclical, given its appeal as a store of value.

Will 2023 be the year that gold finally breaks out?