The dream of hitting millionaire status used to symbolize the peak of financial success. But in today’s economic landscape, even a $1-5 million retirement nest egg may not offer the security it once did due to the expenses that might come with long-term care and safeguarding your retirement assets yourself. As you navigate the so-called “golden years,” the last thing you want is to live in fear of bankruptcy.

Fortunately, there are strategies like IRAs, 401ks, and particularly Medicaid Trusts that could legally shield your assets and retirement accounts from creditors. In this article, we delve into how setting up a Medicaid Trust could be a game-changing move for your retirement planning.

Key Takeaways:

Rising Bankruptcy Among Seniors: Due to reduced income and increased healthcare costs, bankruptcy rates are rising among older Americans, emphasizing the importance of financial planning.

Asset Protection with Medicaid Trusts: Medicaid Trusts can legally shield your assets from creditors, offering a strategic move for retirement planning.

Role of Trustees and Beneficiaries: Selecting a reliable trustee and beneficiaries is essential in the setup of a Medicaid trust, ensuring proper management and distribution of assets.

Professional Guidance: Collaborating with financial, legal, and tax professionals is crucial when establishing a Medicaid trust, ensuring adherence to Medicaid regulations and potential tax implications.

The Rise of Bankruptcy in Retirement

In the context of planning for your retirement, one risk that can’t be ignored is the rising rate of bankruptcy among older Americans.

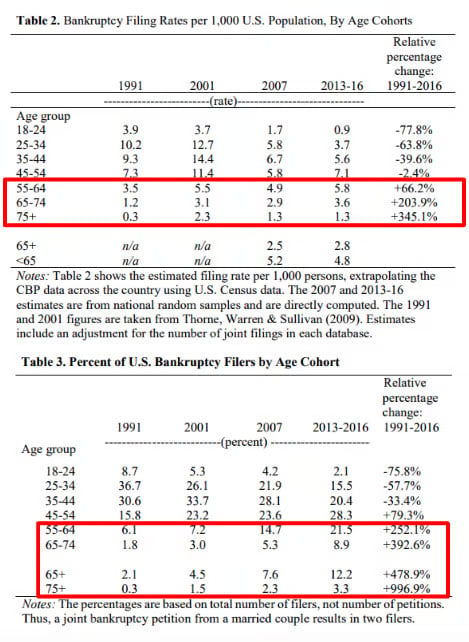

According to a 2018 report from the Consumer Bankruptcy Project, there’s been a more than two-fold increase in bankruptcy filings among Americans aged 65 and over. Furthermore, those aged 55 and older now account for 20% of all bankruptcy filings, doubling in the past 16 years.

Percent of US bankruptcy filers by age

While seniors make up only 8% of total bankruptcy filings, their representation is growing—a trend that’s expected to worsen as 10,000 Baby Boomers retire each day.

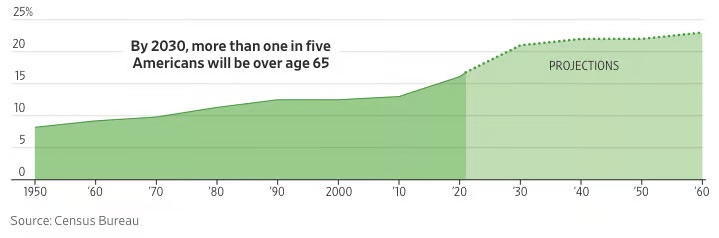

Projected growth in American retirees over the coming decade. Image Source: Wall Street Journal

he core issues driving this trend are reduced income and increased healthcare costs, both of which can significantly impact your financial stability and the longevity of your nest egg. Let’s dig a bit deeper into how this happens.

How Seniors Could End Up Going Bankrupt Over Medical Expenses

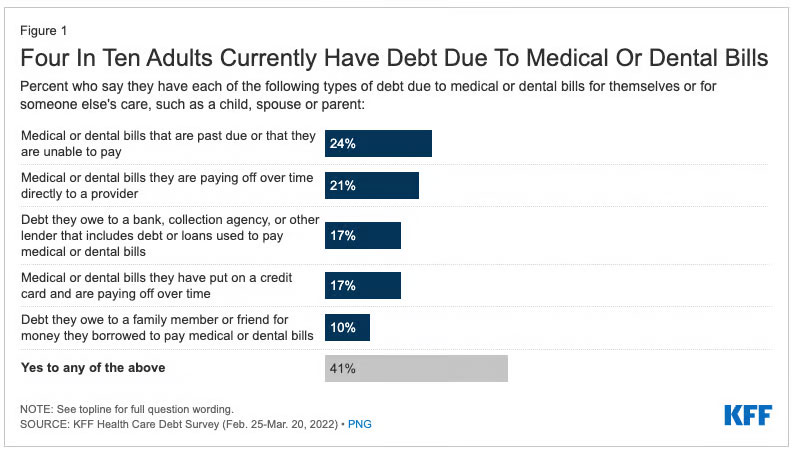

The high cost of healthcare in the United States can be a major financial burden for seniors, especially those who are not covered by Medicare or Medicaid. In fact, a study by the American Journal of Public Health in 2019 found that 66.5% of bankruptcies in the U.S. are due to medical issues.

Number of adults who have debt to due medical or dental bills. Source: KFF.org

There are a number of ways that seniors could end up going bankrupt over medical expenses. For example:

They may have a high-deductible health plan that requires them to pay a significant amount of money out of pocket for medical care.

They may have a chronic illness that requires expensive medications or treatments.

They may have lost their job and their health insurance as a result.

They may have had to take on caregiving responsibilities for a spouse or other family member, which has limited their ability to work.

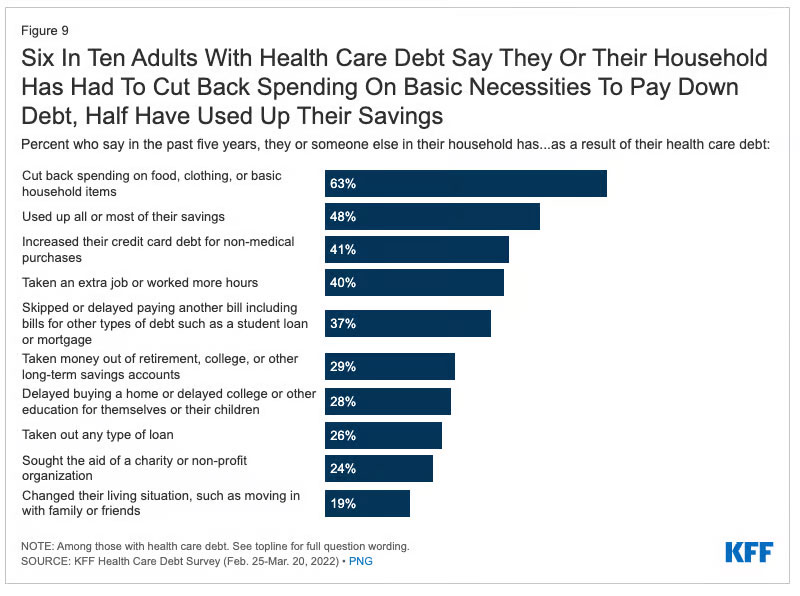

When seniors are faced with overwhelming medical expenses, they may be forced to make difficult choices about how to pay for their care, including:

-

Cutting back on food, clothing, and other basic necessities.

-

Using up their savings.

-

Increasing their credit card debt.

-

Taking on an extra job or working more hours.

-

Skipping or delaying paying other bills or debt.

Number of adults who have had to cut back spending due to health care debt. Source: KFF.org

These trade-offs can have a negative impact on seniors’ health and finances. They may also lead to bankruptcy, which can have a lasting negative impact on their credit score and ability to borrow money in the future.

It’s a sobering reminder of the importance of financial planning, including strategies like Medicaid Trusts, to protect your assets as you age. But what is a Medicaid trust, exactly?

Understanding Medicaid Trusts

A Medicaid Asset Protection Trust (MAPT) offers strategies to protect your assets from creditors in the event of long-term care costs or Medicaid eligibility requirements. By creating this trust, you can secure your wealth for future generations while still complying with relevant laws. The trust shields asset resources so they won’t be confiscated under estate recovery rules set by Medicaid.

How Medicaid Trusts Work

Medicaid is a government program that provides health insurance for low-income individuals and families. However, in order to qualify for Medicaid, you must have very few assets. This can be a problem for seniors who have spent their lives saving for retirement.

One way to protect your assets and still qualify for Medicaid is to set up a Medicaid trust. A Medicaid trust is an irrevocable trust that is designed to help seniors qualify for Medicaid. You can transfer various types of assets into this trust, including passive real estate properties, to shield them from potential creditors.To elaborate, an irrevocable trust is a type of trust where its terms cannot be modified, amended or terminated without the permission of the grantor’s named beneficiary or beneficiaries.

When you transfer assets into an irrevocable trust, you’re essentially giving them away. In this way, the trust can help you qualify for Medicaid by reducing your countable assets. The Medicaid “look-back” period for assets transferred is five years, which means that asset transfers made within five years prior to applying for Medicaid can affect eligibility.

There are a few things to keep in mind when setting up a Medicaid trust:

You must set it up at least five years before you apply for Medicaid.

The trust must be structured correctly in order to be approved by Medicaid.

You must have a trustee who will manage the trust according to the terms of the trust document.

Setting up an accurately designed Medicaid asset protection trust is critical if you want your property and belongings left intact for future generations or beneficiaries after passing away. Buy, borrow, die is another strategy used by wealthy individuals to leave assets to their heirs—oftentimes tax-free.

Types of Medicaid Trusts

For those looking to make the most of their Medicaid benefits, it is important to understand which type of trust best fits their individual circumstances. Three types are commonly used – Medicaid Asset Protection Trusts (MAPTs), Qualifying Income Trusts (QITs) or Miller trusts, and irrevocable funeral funds/trusts for burial fees.

MAPTs help maintain eligibility by shielding assets while staying within asset limits. Conversely, QITS assists with gaining qualification when income exceeds set levels.

Tax Benefits of Medicaid Asset Protection Trusts

For those seeking asset protection, as well as the potential to make use of capital gains tax exclusion on their primary residence, a correctly created Medicaid Trust (MAPT) could be beneficial.

It’s a good idea to speak with financial advisors and tax experts as they can give you advice on how to set up your trust in the best way possible, especially when it comes to making the most of capital gains taxes. This will help you avoid any losses or eligibility issues due to poor planning or organization.

Establishing a Medicaid Asset Protection Trust (MAPT)

The Affordable Care Act established a new methodology for determining income eligibility for Medicaid, which is based on Modified Adjusted Gross Income (MAGI). MAGI is used to determine financial eligibility for Medicaid, CHIP, and premium tax credits and cost sharing reductions available through the health insurance marketplace. Proper usage of an irrevocable trust is a key element in reducing your MAGI in order to meet the eligibility requirements of Medicaid.

Transferring Assets into the Trust

When it comes to transferring assets into a MAPT, having an understanding of the types of assets that can be included is paramount. Investment, savings accounts, and properties are among the countable resources typically moved in this way. You should consult with your lawyer who drafted the trust and also consider potential issues such as Medicaid’s five year look-back period in order to make sure the trust will stand up to scrutiny and ensure eligibility.

The Role of Trustees

When constructing a Medicaid Asset Protection Trust (MAPT), there are three parties that must be considered:

Grantor: The person who creates the trust, transferring assets into it for protection.

Trustee: The individual, often a trusted third party, who is responsible for managing the assets within the trust according to its terms.

Beneficiary: The person or entity who will receive the benefits or assets from the trust, as stipulated in the trust agreement.

In order to construct the trust correctly, you – the person looking to qualify for Medicaid – will be the Grantor. However, in order for the trust to be considered valid, you cannot also be the trustee and/or the beneficiary. Instead, you will need to choose a qualified third party – like a family member or attorney – to direct funds on your behalf.

Choosing Beneficiaries

When selecting beneficiaries to ensure your assets are dealt with according to your plans, you should factor in the person’s relationship and financial situation. MAPTs provide for people other than the trustmaker or their partner, such as an adult child or relative. Also, some trusts, like irrevocable ones, give a limited power of appointment so that changes can be made if needed at any point down the line. It is vital these decisions be considered thoroughly so those left behind will have what they need when you’re gone.

Man signing a legal document, such as a Medicaid Trust document

Limitations of a Medicaid Asset Protection Trust

Establishing a Medicaid trust has its limitations, primarily that you lose control of the assets in the trust after it is created. This means that you – the person seeking to qualify for Medicaid – should not receive an income directly from the trust. Instead, the trust should pay for expenses on your behalf.

Any earned income from this plan may put your recipient over Medicaid’s allowable income limit for eligibility, so understanding these restrictions and getting advice beforehand are important considerations before deciding whether or not to set up a MAPT. You also cannot make any changes once it is established. As a side note, this setup is somewhat similar to how blind trusts allow individuals to relinquish full control and management of the trust’s assets to an independent party

Collaborating with Professionals on Medicaid Asset Protection Trusts

Creating a long-term care plan should include advice from professionals in the financial, legal and tax fields. Financial advisors can provide insight into how Medicaid trust funds may affect your finances, tax experts will assess any possible implications for taxation, and legal representatives will handle all of the processes and legal or tax advice related to establishing and maintaining such trusts. As well as protecting assets financially, this is also vital for ensuring that you meet medicaid eligibility requirements too.

An elder law attorney, on the other hand, can assist in navigating the legal complexities involved while guaranteeing adherence to all of Medicaid’s regulations. They provide assistance with transferring assets, executing estate plans, as well as helping throughout any medicaid planning and application processes that may arise.

The Pros and Cons of an Irrevocable Medicaid Trust

When making decisions about long-term care planning, it is important to look at all the pros and cons of a Medicaid trust. While such trusts can protect assets and bring with them tax advantages, they also mean giving up control over certain assets and properties as well as potentially influencing eligibility for Medicaid benefits.

Having said this, by taking into account each element involved in establishing a trust fund and consulting experts ( elder law attorneys, financial advisors) on the matter, you can decide for yourself whether or not setting up an irrevocable Medicaid trust is suitable for your situation.

Frequently Asked Questions?

What are the advantages of a Medicaid Trust?

A Medicaid Trust provides significant advantages such as protecting your assets from creditors and potential long-term care costs, and aiding in Medicaid eligibility. It also offers potential tax benefits and ensures that your wealth is secured for future generations while adhering to relevant laws.

What are the disadvantages of a Medicaid trust?

A potential issue with establishing a Medicaid trust late is that it may not be enough to protect assets, resulting in an inability of the beneficiary to receive medicaid benefits.

Who are good candidates for a Medicaid Asset Protection Trust?

Individuals who are good candidates for a Medicaid Trust are those who have significant assets they wish to protect from potential long-term care costs, and those who want to ensure their eligibility for Medicaid. It is particularly beneficial for those who want to secure their wealth for future generations while staying within the bounds of relevant laws.

Can I use a Medicaid trust if I’m already past retirement age?

Many people at or near retirement age (65) may wonder if its too late for them to take advantage of this strategy. Yes, you can establish a Medicaid trust even if you’re already past retirement age. However, it’s important to remember that Medicaid has a five-year look-back period, so any asset transfers within five years prior to applying for Medicaid can affect your eligibility.

Do I need a Medicaid Trust for both me and my spouse? Or will one trust work for both of us?

A single Medicaid Trust can typically be established to cover both spouses. However, the specific rules and requirements may vary based on your state’s laws, so it’s best to consult with a legal professional to understand your options.

What happens if I don’t have any living family members to be trustee. Who do I choose?

If you don’t have any living family members to act as a trustee, you can choose a trusted friend, or appoint a professional trustee. Professional trustees can be a bank, a law firm, or a company that specializes in trust management.

How much money does it cost to set up a Medicaid Asset Protection Trust?

The cost of setting up a Medicaid Trust can vary widely depending on your specific circumstances and the attorney you choose, but it generally ranges from $2,500 to $12,000.

How long does it take to get a Medicaid Asset Protection Trust set up?

The time it takes to set up a Medicaid Trust can vary depending on individual circumstances, but it generally ranges from a few weeks to a few months.

How do I find a law firm who can setup a Medicaid Asset Protection Trust for me?

You can find a law firm to set up a Medicaid Asset Protection Trust by conducting online research, asking for referrals from financial advisors, or consulting with local bar associations for recommendations.

Does it make a difference what state I live in for a Medicald Asset Protection Trust?

Yes, the specific rules and requirements for setting up a Medicaid Trust can vary based on your state’s laws.

What is the 5-year look back period for Medicaid asset protection trusts?

The 5-year look back period for Medicaid asset protection trusts is a critical aspect of Medicaid’s eligibility criteria. This period refers to the five years immediately preceding the date of your Medicaid application. During this time, Medicaid reviews all your financial transactions. Any asset transfers that you’ve made within this period, can affect your eligibility for Medicaid benefits. The purpose of this rule is to prevent individuals from giving away assets or selling them at a reduced price to qualify for Medicaid. If you’re found to have violated this rule, you could be subject to a penalty period, during which you’re ineligible for Medicaid benefits.

What is the 5 year rule for trusts?

The five-year rule states that any beneficiary must withdraw the remaining trust assets within a period of five years following the death of the owner. This rule applies for owners who die before reaching age 72 and provides tax benefits, such as the step-up in basis upon death and capital gains exclusion on primary residence.

Want to learn more about investing in private market deals?

Here at Equifund, we help investors access early-stage opportunities not found anywhere else.