Thank you for your participation in Sky Quarry’s Regulation-A+ offering. As you may know, Sky Quarry is pursuing a potential public offering on the Nasdaq in the very near future.

In an effort to help all Equifund members who participated, this guide is designed to walk you through the necessary steps you must take to transfer your shares held in “Book Entry” with the Transfer Agent into your stock brokerage account (called a “DRS Transfer”).

What is Book Entry?

Book entry is a method of tracking ownership of securities where no physically engraved certificate is given to investors. Securities are tracked electronically, rather than in paper form, allowing investors to trade or transfer securities without having to present a paper certificate as proof of ownership.

When an investor purchases a security, they receive a receipt and the information is stored electronically.

Book-entry securities are settled by the Depository Trust Company (DTC), which is the Depository Trust & Clearing Corporation’s (DTCC) central securities depository.

If you have, or have had, a brokerage account and purchased securities in that account, it’s the exact same thing. You see the securities in the account, but you don’t receive physical shares. It’s all handled electronically by DTCC.

In this guide, we’ll walk you through exactly

what to do to get ready for a DRS Transfer should Sky Quarry complete their

public listing and become a tradable security.

STEP 1) Get Your Documentation Ready

While you may not need your executed subscription agreement (ESA) to transfer your shares, as a general consideration, you will want to have a copy of your original, executed subscription agreement. You should be able to find this inside your Equifund account under My Documents. If you cannot locate this document, email [email protected] and we can assist you further.

Once you have this, check your executive share purchase agreement with your account statement to make sure they match.

Please note that Sky Quarry management recently conducted a 1-for-3 reverse stock split in order to meet the minimum share price required by the Nasdaq. This means that for every three shares of Common Stock (or warrants to purchase Common Stock) held previously, shareholders now hold one share (or warrant), with prices adjusted accordingly (increased 3x).

As a reminder, when you participated in the offering you purchased something called a Unit.

Each Unit you purchased contains one share of the Company’s common stock (a “Common Share“); and one Common Share purchase warrant (a “Warrant“) to purchase one additional Common Share (a “Warrant Share“) at a price of $2.50 USD per share, subject to customary adjustments, over a 36-month exercise period, following the date of the issuance of the Warrant.

A Warrant is a contract between the Issuer (i.e., the company) and the Investor (i.e., you) that grants the option to buy more shares – at a pre-negotiated price (the “exercise price” or “strike price”) – for a specific period of time (the “expiration date”).

STEP 2) Register for online access to your Colonial Stock Transfer Account (if you haven't already)

Currently, your shares are held in Book Entry with Colonial Stock Transfer Company (the “Transfer Agent”).

You might have heard of the term “transfer agent” and “stockbroker” used interchangeably. However, it’s important to note these two are different roles.

Because transfer agents act as a go-between for stockbrokers and registrar and transfer companies, they are responsible for some different tasks.

For instance, transfer agents are responsible for registering stock ownership, transferring stocks from one person to another, and issuing shares of stock.

In order to initiate the DRS Transfer – from the Transfer Agent to your Stockbroker – you will need to find your account statement.

In order to gain access to this record, you will need to create an account with the Transfer Agent.

Please Note: If you already have an existing Colonial Stock web user account and are a U.S. investor, you can add this account to your online profile by clicking on your username in the upper right corner of the site. Then click ‘Manage Account.’ Next to Accounts, click ‘Add Other Accounts to My Profile.’

Then enter your PIN, SSN, and Account Number to add the account. Non-US investors can email [email protected] with your account numbers and we will link them within two (2) business days.

As a shareholder you can register for online access to view your holdings, certify your taxpayer number, update your contact information and more, utilizing the following registration instructions:

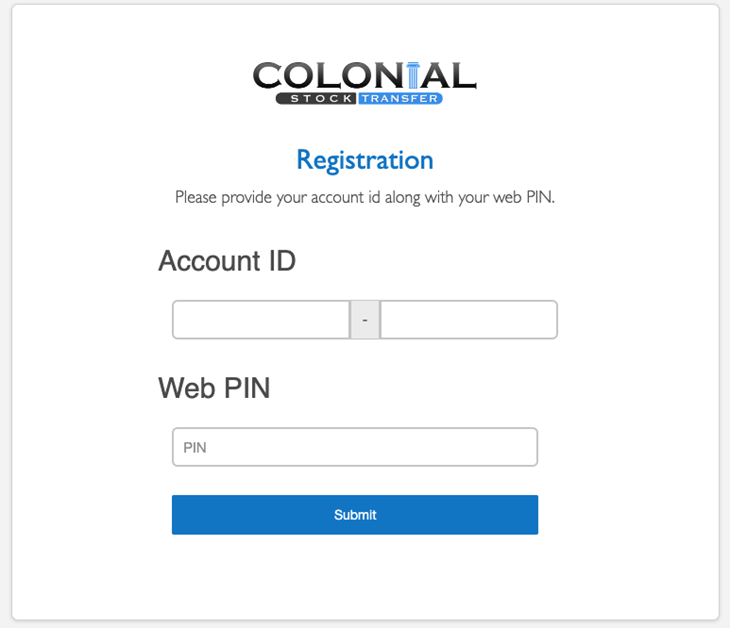

- Click here to navigate to the registration portal

- Enter your account ID: This is a six digit number on your statement (XXX-XXX)

Enter your WebPIN: This is a number on your statement (XXXXX). Please note that the only purpose of this WebPIN is to gain access to your online account at Colonial.

- Follow the prompts to register your account.

If you don’t know your Account ID or Web PIN, please check your email inbox for an email from [email protected] with the subject line ‘SKY QUARRY INC – Shareholder Online Enrollment Instructions’.

Please do not contact Equifund Support staff to ask about your Account ID or Web PIN, as we are unable to look up this information for you.

If you cannot find this information, please email [email protected] for help.

Use the the subject line: “Sky Quarry Web Registration Instructions” and list the name you used to purchase your shares of Sky Quarry in the body of the email. As a reminder, this name can be found on your executed subscription agreement.

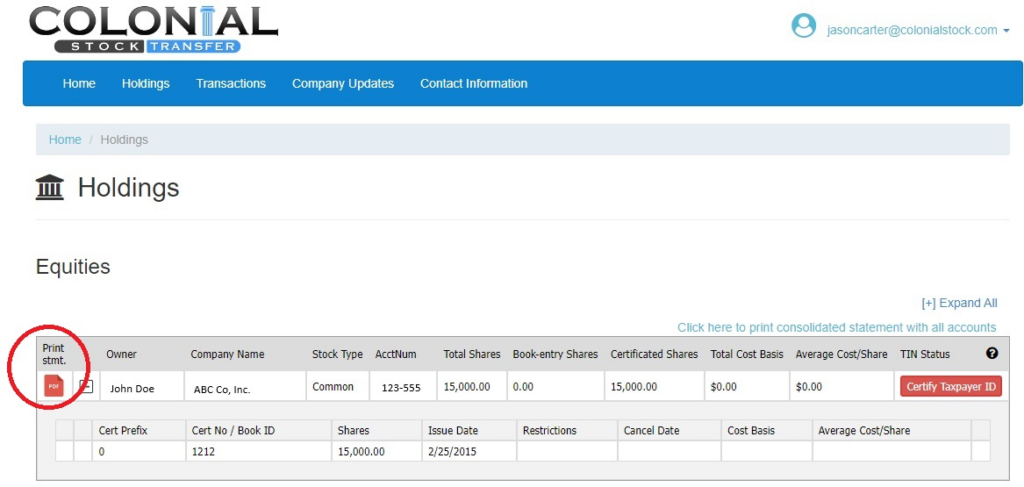

STEP 3) Download your holdings statement from your Colonial account, here are the steps to do that:

- Login to your Colonial account here: https://sh.colonialstock.com/Account/Login/

- Click on the red PDF icon to download your statement. This icon is on the left side of your Sky Quarry position. You will see a screen that looks like the screenshot below.

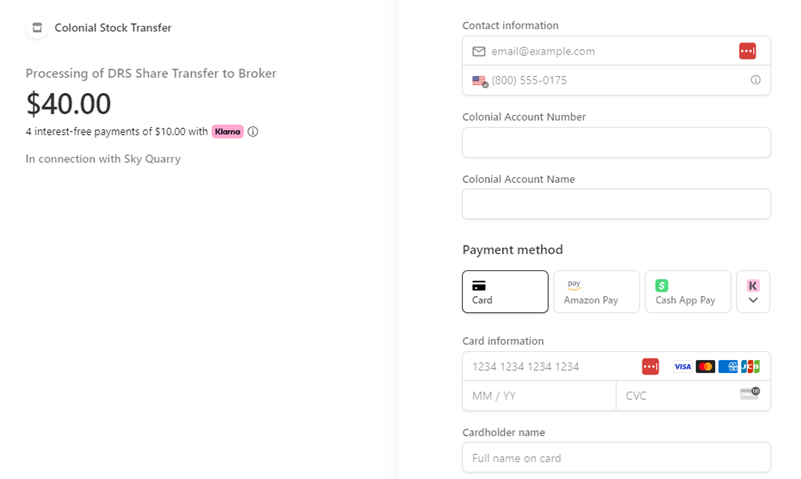

STEP 4) Pay the $40 DRS Transfer Fee

Once you have your account opened and you have retrieved your account statement, the Transfer Agent will require you to pay a $40 fee to transfer the securities to your brokerage account.

To pay this fee, click here now. You will see a screen that looks like the screenshot below.

Choose your preferred form of payment and follow the instructions on screen.

STEP 5) Contact your broker

If you do not already have a broker, you will need to open an account. While we don’t endorse any specific broker, some of the largest brokerage firms are:

- Charles Schwab: Use this link to open an account

- Fidelity Investments: Use this link to open an account

- E*TRADE (Morgan Stanley): Use this link to open an account

- Merrill Edge: Use this link to open an account

- Vanguard: Use this link to open an account

- Interactive Brokers: Use this link to open an account

- Tasty Trade: Use this link to open an account

Most brokers will, in one way or another, force you to call (or email) a specific department in order to complete a DRS transfer. In addition, your broker will likely need to initiate the transfer on your behalf, from the Transfer Agent into your brokerage account.

Generally speaking you will be asked for the following information:

- The Transfer Agent’s name, DTC number, and address:

Colonial Stock Transfer, DTC# 7918, 7840 S 700 E, Sandy, UT 84070 - Your name and address as registered with the transfer agent

- Your account number at the transfer agent

- The name and DTC number of your brokerage firm to which you wish to transfer your shares

- Your account number at your brokerage

- The name of the stock (Sky Quarry, Inc), its ticker symbol (SKYQ)

- The post-split CUSIP is: 83087C204 and the

Security number: 3264306 - The number of shares you want to transfer

- Your Social Security Number or Tax ID Number (and any other additional security questions they need to confirm your identity)

Potential Issues with Self Directed IRAs

If you invested in this offering using your retirement funds via a self-directed IRA (SDIRA), you may run into a few problems.

If you use a Custodian Controlled SDIRA – for example, AltoIRA, Madison Trust, Equity Trust, Directed Trust, or New Direction Trust Company – oftentimes, these firms are not registered as a broker dealer, cannot facilitate ACATS transfers or DWAC transfers, and do not have the capability of selling/trading on our platform.

What are ACATS transfers?

ACATS (Automated Customer Account Transfer Service) transfers are a method of moving securities from one brokerage account to another at a different firm electronically. Instead of manually transferring each asset, ACATS automates the process, allowing for efficient and standardized transfers of various investment products.

When an investor initiates an ACATS transfer, they complete a Transfer Initiation Form (TIF) with the receiving firm, and the transfer is processed electronically through the ACATS system.

ACATS transfers are facilitated by the National Securities Clearing Corporation (NSCC) and are available to NSCC-eligible members and Depository Trust Company (DTC) member banks. The process typically takes 3-6 business days to complete and is governed by FINRA Rule 11870, which requires firms to expedite and coordinate transfer activities.

What is DWAC?

DWAC (Deposit/Withdrawal At Custodian) is an electronic method of transferring securities between a broker-dealer and the Depository Trust Company (DTC). It allows for the direct movement of shares between a transfer agent and a brokerage firm, bypassing the need for physical certificates.

When an investor initiates a DWAC transaction, the shares are electronically transferred to or from their brokerage account, with the DTC acting as the intermediary.

DWAC transactions are facilitated by the DTC’s FAST (Fast Automated Securities Transfer) system, which allows for quick and efficient transfers of securities. This process typically takes only a few days, compared to the weeks it might take with traditional physical certificate transfers.

As a result, this means you will need to go through a multi-step (and very manual) process of retitling your shares to a DIFFERENT retirement account – which you may have a brokerage account opened up for already – and then DRS transfer your shares into that other retirement account.

Here’s how you can retitle shares at Colonial Stock Transfer:

1) Complete the Transfer Instruction Letter:

- Download the Transfer Instruction Letter form from Colonial Stock Transfer’s website.

- Fill out all sections (A-G) of the form.

- In Section A, provide the current owner’s name and certificate information.

- In Section B, include the new registration details (names, addresses, and Tax ID numbers for all individuals receiving shares).

2) Sign the Transfer Instruction Letter:

- All currently registered owners must sign the form.

- If transferring to parties other than those listed on the stock certificates, obtain a Medallion Signature Guarantee.

3) Include executed Share Purchase Agreement:

- Because you were not issued physical stock certificates, you will need to send in the executed share purchase agreement along with the Transfer Instruction Letter.

4) Provide payment:

- Include a check payable to Colonial Stock Transfer for the applicable fees listed in Section G of the Transfer Instruction Letter.

5) Additional documents (if applicable):

- For transfers from business entities: Include a copy of the Corporate Resolution, Partnership Agreement, or LLC Certification.

- For transfers involving trusts: Include relevant trust documentation.

- For transfers from deceased shareholders: Include additional forms as specified in Colonial’s FAQ page.

6) Submit the documents:

- Mail all required documents to Colonial Stock Transfer’s address.

- It’s recommended to use a courier service (e.g., FedEx, UPS) for secure delivery.

7) Processing time:

- Colonial usually takes 1-3 business days to process the request and return certificates.

- Rush requests can be processed on the same day for an additional $125.00 fee.

If you are using a Checkbook Controlled IRA, LLC – one of the biggest problems can be simply finding a custodian who will open up an account for this type of entity.

After much investigation, it appears that TastyTrade is the only major brokerage platform that will open accounts for an IRA structured as an LLC with checkbook control.

If for any reason you cannot resolve the issue of getting a brokerage account opened, you can retitle the shares as per the previous instructions.

Potential Issues for Non-US Investors

If you are a non-US citizen – and you do not have a US-based brokerage account – you may run into some challenges with the DRS transfer to a non-US broker.

The first thing you’ll need to do is ensure that your brokerage is eligible for DRS transfers. This means that the brokerage must be a DTC participant, possess a PSP (Profile Surety Program) number, and have the capability to handle DRS positions.

Next, contact your non-US broker to inform them of your intention to transfer shares via DRS.

- It’s essential to ask about their specific requirements and procedures for such transfers, as they may need to collaborate with a custodian or clearing firm that has DTC access.

Once you have the necessary information, provide your brokerage with the company’s CUSIP number, your shareholder account number, taxpayer identification number, and the name in which the shares are registered.

Additionally, specify the number of shares you wish to transfer.

To initiate the transfer, if your brokerage participates in the DRS Profile system, they can request the shares electronically. If they do not participate in this system, you may need to send written instructions directly to the transfer agent.

In some cases, you might also need to provide a Medallion Signature Guarantee from a financial institution for these written instructions.

- Be prepared for potential challenges during this process, as non-US brokers may have limited experience with DRS transfers.

If you encounter difficulties with a direct DRS transfer, consider transferring the shares first to a US-based brokerage before moving them to your non-US brokerage. Throughout this entire process, maintaining clear communication with both your brokerage and the transfer agent is crucial for a smooth transfer experience.