What key piece of information separates the ultra-rich from the average investor? In simple terms, it’s knowing how to use debt to purchase assets and build wealth.

The key to building wealth with efficient debt, is understanding the difference between corporate and personal finance. In personal finance, most people use debt to acquire liabilities. In corporate finance, people use debt to acquire cash flow-producing assets and leverage the tax code (i.e., depreciation) to maximize profits.

In this article, you’ll learn how to differentiate between good and bad debt, explore examples of each, and discover how the ultra-rich use debt to get richer (mainly through Leveraged Buyouts).

Key Takeaways:

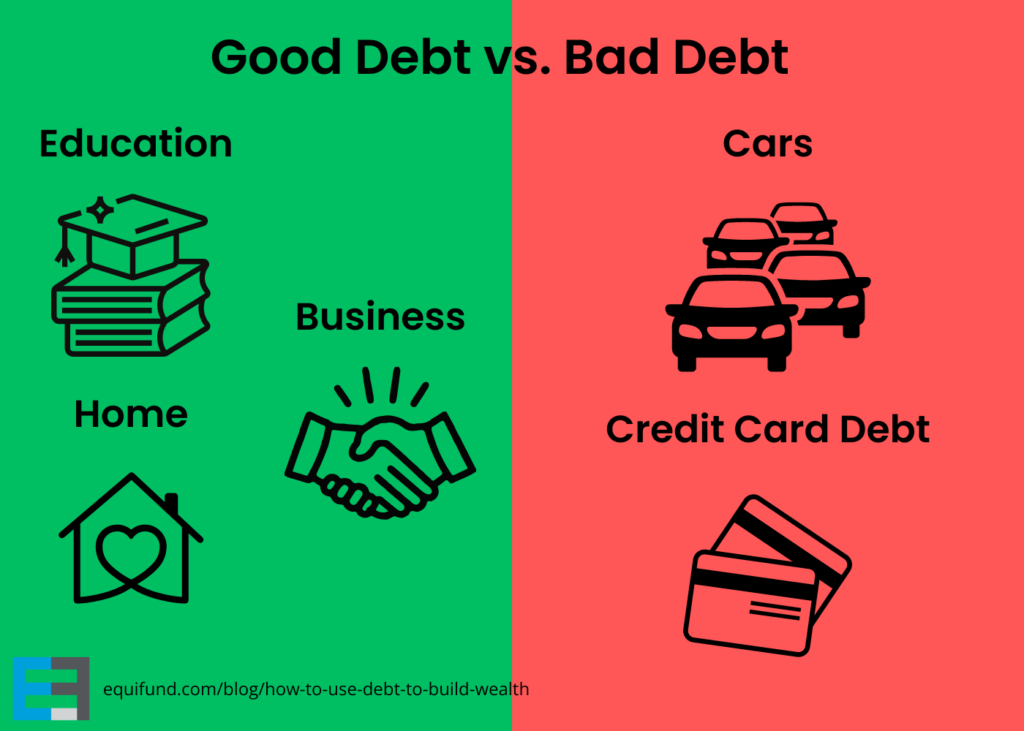

Understanding Good vs Bad Debt: Good debt refers to borrowing for investments that generate more income than the debt’s interest payments. Bad debt involves borrowing for non-income producing expenses.

Leveraged Buyouts (LBOs): Wealthy individuals and PE firms use LBOs to acquire revenue generating companies using borrowed money – as much as 90% of the purchase price – and then look to sell the company ~3-5 years later for a profit.

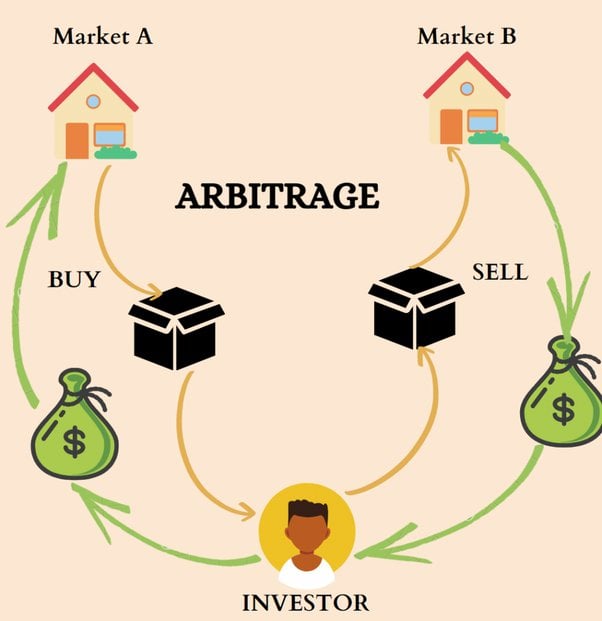

Arbitrage Strategy: The rich create passive income by borrowing against income-generating assets, thus earning more from the asset than they repay in interest.

Buy, Borrow, Die Strategy: This strategy involves buying appreciating assets, borrowing against them, and letting heirs inherit the assets to avoid capital gains tax.

Managing Leverage Risks: Leveraging debt can increase wealth, but it also magnifies risk, liquidity issues, and costs, hence needs careful management.

Understanding Good and Bad Debt

Examples of good vs bad debt.

While debt is often viewed as a liability, many of the world’s wealthiest individuals leverage debt to amplify their wealth. Good debt refers to money borrowed to purchase an asset that is expected to create greater income than the debt servicing cost. This type of borrowing may potentially lead to greater wealth creation when compared to purchasing assets with cash-only (although there is more risk). Bad debt, on the other hand, involves borrowing money to make purchases that do not generate any additional income or value over any time period, and the interest must be paid back from other sources of income.

Examples of Good Debt

Mortgage loans can be good debt as long as the rental income covers loan payments and property expenses.

As mentioned above, good debt is used to acquire assets that generate income, while the cost of the debt is reasonable compared to the expected returns. Examples of good debt include:

Mortgage Loans

This involves borrowed money to get a home loan (for House Hacking) or purchase rental properties whose income generally exceeds the sum of the mortgage payments and maintenance costs. Not to mention, there are tax advantages like deductions for loan interest or property expenses. The one thing to keep in mind is avoiding too much borrowing, which could cause difficulties in repaying loans.

Business Loans

Investing in business expansion is one common answer to how to use debt to build wealth.

Entrepreneurs often secure loans at reasonable interest rates to fund expansion plans, such as buying new equipment or acquiring a competitor.

By borrowing money, business owners are able to finance the cost of expansion without sacrificing ownership. This provides much greater flexibility than equity funding does.

However, because lenders often ask for some form of collateral for the loan, there is always the risk of losing the asset should you default on loan payments. Before making any decision about this type of finance option, one should carefully consider your firm’s present financial situation, have a clear understanding of the cost of capital in the current environment, and if you’re able to service the debt responsibly and otherwise make it a productive loan.

Student Loans

Many people would agree that investing in your education – as long as it leads to higher lifetime earning potential and future results – is a good investment. This is why millions of people decide to take out student loans to pursue higher education.

However, student loans are one of the only forms of debt that cannot be discharged through bankruptcy. This means even if you can take out a student loan for a substantial amount of money at relatively favorable rates, there is a certain level of risk to this type of debt.

Regardless, many of the worlds wealthiest people are lifelong learners and constantly look for ways to increase their knowledge, whether that is through additional degrees, certification programs, coaching and mentorship programs, books, courses, and other classes.

Plus, certain educational expenses are tax deductible.

Before you decide to borrow any money to fund any educational expense, make sure you understand the terms of the loan, are able to afford the expected monthly payments, and are focused on your financial goals and acquiring knowledge and skills that have the potential to increase your lifetime earnings potential.

Examples of Bad Debt

Bad debt (AKA inefficient debt), such as car loans, payday loans and credit cards, can be detrimental to your wealth-building goals as they don’t end up producing any income. Let’s dive into a few examples of bad debt.

Credit Card Debt

Today, credit card debt in America is at an all time high. According to the U.S. Census Bureau, each U.S. household has nearly $8K in credit card debt on average. Even though many credit card companies offer enticingly low promotional rates – in some cases, 0% interest for 6 – 24 months – many credit card companies charge annual interest rates above 24.99% once that promotional period expires. Because of this, it can be easy to put yourself in a position where the debt servicing costs exceed the amount you borrowed if you are not careful.

Also, as a word of warning, even if you have a 0% promotional rate, you are still required to make a minimum monthly payment. If you do not, the credit card company will consider that a “default” on payment and immediately bump you up to the full interest rate. As you can imagine, most people don’t know this when they take out large balances on 0% credit cards and wind up trapped in a high interest loan when they had budgeted for a 6-24 month payback period.

In some cases, business owners will make smart use of these low interest rate credit card promotions to finance business expansion, which makes it Good Debt. However, many people use credit cards to purchase items like electronics, clothes, vacations etc.

Payday Loans

Payday loans are often considered a highly predatory form of financing designed to take advantage of lower income earners who don’t have access to traditional forms of credit. One of the major concerns about this type of debt is that it has the potential to trap the borrower into an inescapable cycle of borrowing money to pay their bills, and then borrowing more money to pay back the lender.

Car Loans

Car loans can be a form of bad debt due to the average car losing half of its value in the first five years. This means that you could end up owing more on your car loan than the car is worth. Car loans also typically have interest rates that are higher than other types of loans, such as mortgages or student loans. This means that you’ll pay more interest over the life of the loan. Finally, car loans can add a significant monthly payment to your budget. This can make it difficult to save money or pay off other debts.

How the Rich Use Debt to Get Richer

The wealthy have developed several methods to utilize debt to their advantage; most notably, because borrowed money does not count as income, it is not taxed. For this reason, wealthy individuals will often borrow money, buy a cash flowing asset, and then legally pay little to no taxes on the income they earn thanks to depreciation and other deductions.

The Arbitrage Strategy

Bankers are masters in creating arbitrage opportunities

While the average investor typically invests for Money Later (i.e. long term wealth and future cash flow), wealthy individuals—particularly Bankers—focus on investing for Money Now (i.e. short-term cash flow).

Wealthy individuals create passive income through arbitrage by finding assets that generate income (such as businesses, real estate, or bonds) and then borrowing money against those assets to get leverage to purchase even more assets. Harnessed properly, this leverage allows the rich to earn more money from the asset than they have to pay back in loan interest.

For example, let’s say a wealthy individual buys a rental property for $1 million. They then borrow $800,000 against the property at a 6% APR. If the property generates $100,000 in annual rent, the investor will still have a positive cash flow of $52,000 per year in addition to $800,000 in fresh investment capital.

But thanks to the way depreciation works, the real estate investor is also able to deduct up to 3.636% o of the property’s value each year ($36,000 in this example) and not pay any taxes on that amount.

This is just one example of how wealthy individuals create passive income through arbitrage. There are many other ways to do it, but all arbitrage opportunities require the following:

An asset that’s income-producing. This means that it must generate cash flow on a regular basis.

A lender that’s willing to lend against the asset as collateral.

Income that’s larger than the loan payments and expenses.

The Buy, Borrow, Die Strategy

Another method employed by the rich to enhance their wealth while avoiding taxes is the Buy, Borrow, Die strategy. Here’s a simplified breakdown:

The first step is to “buy”. A wealthy individual or family procures an asset that’s likely to appreciate over an extended period of time. The second phase of investment strategy is to “borrow”. Instead of selling these assets when they need cash (which would trigger capital gains taxes), they borrow against them, using the asset as collateral.

The final stage is “die”. When the initial owner of the asset dies, the asset is inherited by their heirs or beneficiaries. These beneficiaries can then sell the assets (once they’ve settled the loan balance, of course) without capital gains tax and avoid capital gains taxes due to step-up in basis rules, which we’ll delve into further here.

The Leveraged Buyout Strategy

A private equity (PE) firm is a financial institution that invests in private companies that are undervalued or have the potential for growth. They use a variety of investment strategies, but leveraged buyouts (LBOs) are the most common type of investment for PE firms.

Here’s how PE firms perform leveraged buyouts:

Identify a company that they believe they can make significant operational improvements to. This could involve things like cutting costs, increasing revenue, or expanding into new markets.

Borrow as much money as they can to finance the purchase of the company.

Use the cash flow from the company to service the debt.

Sell the company in the future, hopefully for a profit.

The reason why leveraged buyouts can generate above-market returns is because of the use of leverage. When you borrow money to invest, you can earn a higher return on your investment since you are not putting up as much of your own money.

In contrast to the Buy, Borrow, Die strategy mentioned in the previous section, LBO’s are more like Borrow, Buy, Sell. In many cases, it can even be Borrow, Buy, Plunder, Sell, or Bankrupt (whichever is more profitable). Here’s why.

The Advantages of Using Debt to Build Wealth

Opting to use debt for leveraged buyouts offers various advantages that can optimize profits and lessen the risk. These benefits include limited liability, as well as tax reductions on interest payment expenses.

Limited Liability

Limited liability is a legal concept that limits the financial liability of an individual or entity to the extent of their investment in a particular company or organization. This protection encourages risk-taking investments since it ensures that the business owner’s personal resources are not used to settle any debts incurred by the venture.

When a private equity firm performs an LBO, the debt is taken on by the acquired company, not the private equity firm itself. This means that the PE firm is not directly liable for the debts if the company goes under. As you can probably tell, this gives the PE firm a lot of leeway to take risks.

This means that it’s possible for a PE firm to sell a company’s assets, extract management fees and then walk away with a profit even if it bankrupts the company.

For reference, companies bought by private equity firms are far more likely to go bankrupt than companies that aren’t. Not only that, but over the last decade, private equity firms were responsible for nearly 600,000 job losses in the retail sector alone.

Tax Credits

PE firms can also take advantage of tax credits in the event of bankruptcy. When a company goes bankrupt, the debtholders may not be able to collect all of their money. In this case, the government may offer to provide tax credits to the debtholders to offset their losses. In other words, PE firms that own a company that went bankrupt can claim these tax credits.

Additionally, PE firms may be able to defer paying taxes on the profits they made from a company that went bankrupt. This is because the bankruptcy process can take several years, so the PE firm may not have to pay taxes until the process is complete.

Example of a Leveraged Buyout

In 2007, PE firm Carlyle acquired the nursing home chain HCR ManorCare, using a leveraged buyout. Carlyle then forced ManorCare to pay nearly half a billion dollars a year in rent to occupy buildings it once owned. Carlyle also extracted over $80 million in fees from ManorCare, and the company filed for bankruptcy with over $7 billion in debt. By then, Carlyle had already recovered its money and made millions more in fees.

The family of one ManorCare resident sued Carlyle, but the case was dismissed because Carlyle claimed it did not technically own ManorCare. This a textbook example of how a PE form can use a lot of debt to finance an acquisition, and then put the acquired company in a precarious financial position and make it more likely to file for bankruptcy.

Managing the Risks of Leverage

Successful wealth-building involves both financial planning and taking advantage of leveraging debt. However, investors should also carefully consider the dangers of using leverage, including:

Increased losses: This means that if the investment goes down in value, the investor can lose more money than they originally invested.

Liquidity risk: Leveraged investments can be illiquid, which can be a problem if the investor needs to raise some quick cash.

Costs: Leveraged investments often have higher fees than non-leveraged investments. These fees can eat into the investor’s returns.

As Charlie Munger once said: “There are only three ways a smart person goes broke – liquor, ladies, and leverage.”

Frequently Asked Questions?

What are the tax loopholes for the rich?

Payment of taxes can be significantly minimized for the wealthy through legal tax breaks and loopholes. This includes claiming depreciation, deducting business expenses, hiring their children, rolling forward losses from businesses as other income generated well as earning income off investments such as passive real estate properties.

How do billionaires live off loans?

By pledging their appreciating assets as collateral, billionaires are able to live off their loans as long as their loan payments don’t exceed their investment gains.

How do billionaires avoid estate taxes?

Billionaires often seek to minimize their estate taxes by distributing a portion of their wealth through estate planning. Often times, this includes creating a web of trusts, corporate entities, and charitable foundations that can be used to shield tax liability upon their death.

What percentage of taxes do the top 1 percent pay?

In 2020, the bottom half of taxpayers earned 10.2 percent of total AGI and paid 2.3 percent of all federal individual income taxes. The top 1 percent earned 22.2 percent of total AGI and paid 42.3 percent of all federal income taxes.

In all, the top 1 percent of taxpayers accounted for more income taxes paid than the bottom 90 percent combined. The top 1 percent of taxpayers paid $723 billion in income taxes while the bottom 90 percent paid $450 billion.

According to a 2021 White House report, it is estimated that the 400 wealthiest families in the United States paid an average Federal individual income tax rate of 8.2 percent on $1.8 trillion of income over the period 2010–2018.

Want to learn more about investing in private market deals?

Here at Equifund, we help investors access early-stage opportunities not found anywhere else.