Is gold a good investment? It’s a fair question to ask, since the yellow metal doesn’t earn any interest.

But despite this apparent weakness, gold has historically been regarded as the most potent and reliable store of value across generations.

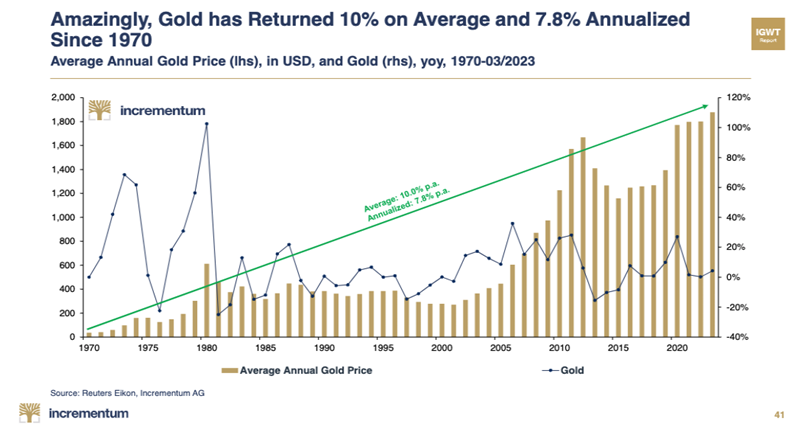

Gold’s average and annualized performance since 1970. Source: Incrementum

Before the 20th century, the gold standard governed international trade, which Jacques Rueff, in his 1964 book “The Age of Inflation,” compared to an “absolute but enlightened monarch.”

In our present-day digital monetary system, vulnerable to long-term instability and systemic collapse risks, has made the timelessness of gold more relevant than ever.

For investors considering adding gold to their portfolio, or simply want to have a better understanding of how investing in gold works, this article presents the top 10 reasons why investors buy gold for their portfolio.

Key Takeaways:

- The Fear Trade: With increasing tensions between the US and Russia/China – both of whom are significant producers of gold – investors traditionally buy the yellow metal in times of crisis. In the past, geopolitical events have been bullish for the price of gold (but not always).

- Supply and Demand: Other investors see the case for gold as a simple “supply and demand” curve – today, there is simply more demand than available supply, with demand being heavily led by central bank purchases.

- Commodity Super Cycle Thesis: Goldman Sachs analysts have been talking about a new capex cycle that could begin in 2023—with better relative returns drawing capital towards commodities and the gold mining sector.

- Portfolio Diversification: Other investors could care less about the “religion of gold” and simply believe the historical evidence that adding gold to a portfolio decreases drawdowns during market crises and delivers improved returns.

- No Counterparty Risk: For investors who are concerned about yet another bank crisis, gold offers potentially the single most compelling value proposition of any asset; because gold has no counterparty risk – meaning, your asset is not someone else’s liability – it effectively exists outside of the banking system.

- Asset Protection: Want to keep your gold away from the sticky fingers of the US government? Thanks to this loophole in the IRS FACTA requirements, US citizens do not have to report foreign holdings for physical precious.

- Golden Barbell Strategy: For investors who familiar with Nassim Taleb’s “Barbell” investment strategy – 90% cash and 10% highly speculative – gold acts as a cash like instrument.

- Universal Liquidity and Convertablity: Gold is one of the few assets in existence that has a global spot market. This means that at any time of day virtually anywhere in the world, you can convert gold into whatever currency you’d like.

- Estate Planning: For thousands of years, gold and silver have been the cornerstone of generational wealth – for families and governments alike. Not only does it serve a purpose as a long term store of value, because of its universal desirability, investors can borrow against their gold holdings and use this asset as part of the “Buy, Borrow, and Die” estate planning strategy.

- Doomsday Planning: Last but not least, if you think that you’ll be in a “post-apocalyptic” scenario – either from natural disasters, war, or other events that force rapid relocation – precious metals are a convenient way to move your wealth (and have it be instantly usable in any other economy you land in).

#1 The Fear Trade

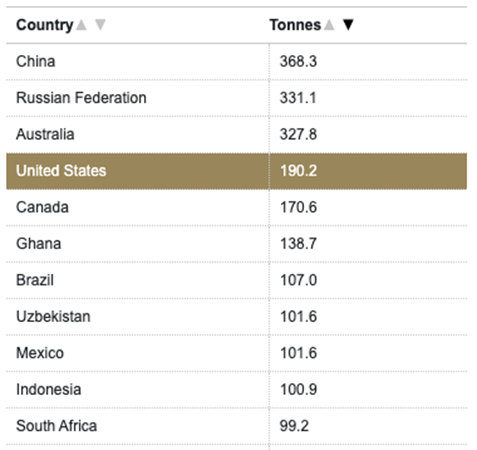

Gold mining is a global business with operations on every continent, except Antarctica. At a country level, China was the largest producer in the world in 2020 accounting for around 11% of total global production.

The world’s largest gold producers. Source Gold.org

With growing geopolitical tensions with the Russia/Ukraine conflict – along with China’s near monopoly on rare earth minerals – it’s a growing possibility that global supply chains for metals goes through a period of instability.

Investors traditionally buy the yellow metal in times of crisis. In the past, geopolitical events have been bullish for the price of gold (but not always).

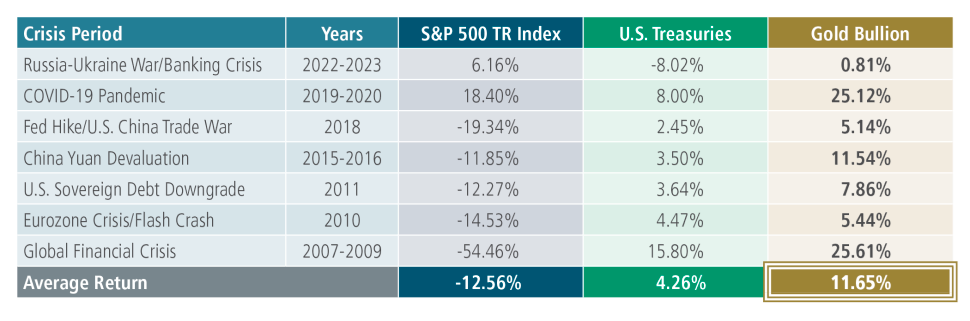

According to Sprott, gold has proven its value as a safe haven asset during the seven crisis periods since 2007—returning 11.65% compared to -12.56% for the S&P 500 and 4.26% for U.S. Treasuries (as of 6/30/2023).

Performance of Gold Bullion vs. S&P 500 and U.S. Treasuries in “Crisis” Periods. Source: Sprott

#2 Supply & Demand Imbalance

Starting in the early 1970s, the volume of gold produced each year has not just increased, it has tripled. On the demand side, gold consumption has quadrupled over the same period. This suggests a consistent, long-term appetite for gold across the globe that is increasing faster than production.

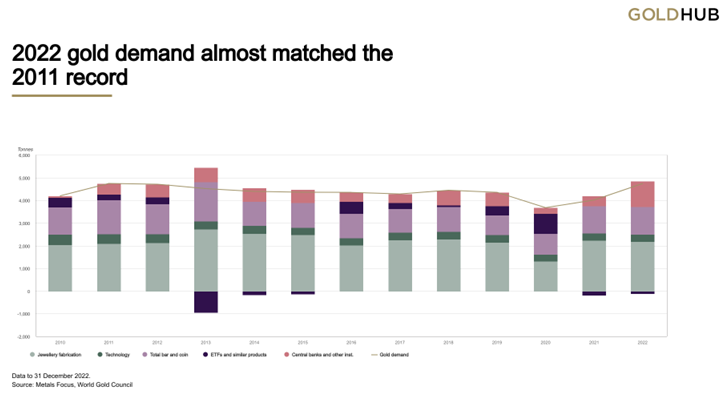

2022 gold demand compared to 2011. Source GoldHub

In 2022, gold demand reached an impressive 11-year high, a surge of 18%. This impressive uptick was driven largely by massive central bank purchases and robust retail investor buying, as reported by the World Gold Council. To put this into perspective, the investment demand for gold alone rose by 10% to 1,107 tons in 2022, despite the fact that the price of gold was on the rise.

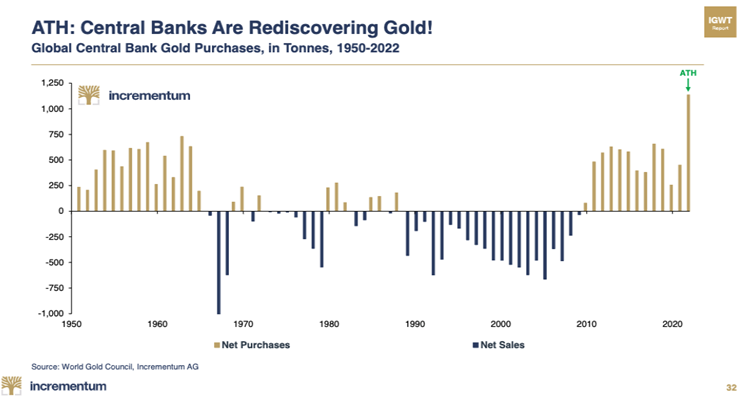

Central bank gold purchases from 1950 to 2022. Source Incrementum

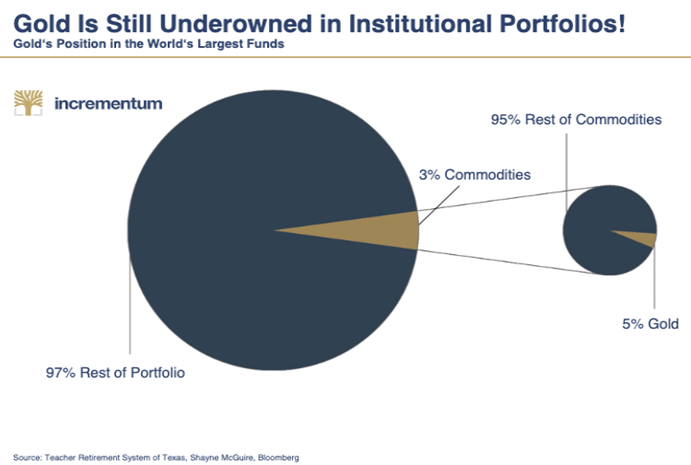

Even more interestingly, the world’s largest funds have an average of 3% of their portfolios allocated towards commodities, and of that, about 5% is devoted to gold. This gives you an idea of the significant role gold plays in the investment strategies of some of the most successful financial institutions around the world.

Gold’s position in the world’s largest funds. Source Incrementum

However, it’s not just central banks and investment funds showing enthusiasm for gold. The world’s wealthiest families have been quietly amassing gold since the 2008/2009 financial crisis, demonstrating a strong belief in its ability to hold value and act as an inflation hedge.

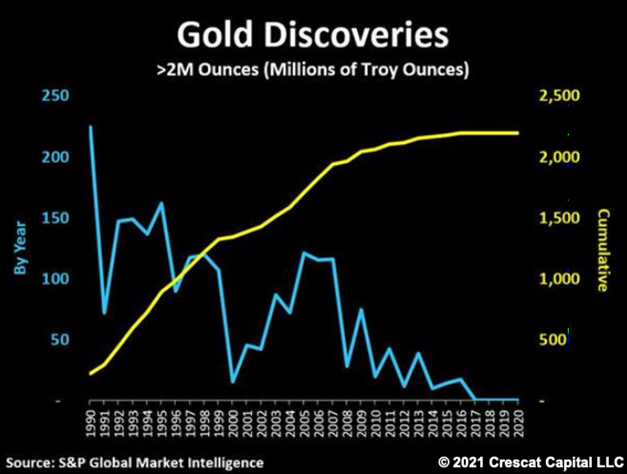

On the supply side, gold miners have failed to find a single deposit above 30 million ounces for the past 20 years. In fact, over the past three years, there hasn’t been a single gold discovery above 2 million ounces.

Gold discoveries above 2 million ounces. Image source: Crescat Capital

This imbalance between supply and demand creates an interesting opportunity for investors. With fewer new deposits being discovered, existing reserves are being depleted. According to S&P Global Market Intelligence, global exploration budgets rose 16% in 2022, following a 34% rebound in 2021, indicating a renewed interest in finding new gold deposits.

Furthermore, the demand for gold is higher than the supply, resulting in an annual shortfall of around 500 metric tons. According to the laws of economics, this imbalance should apply upward pressure on gold prices for the foreseeable future.

#3 The Commodity Supercycle Thesis

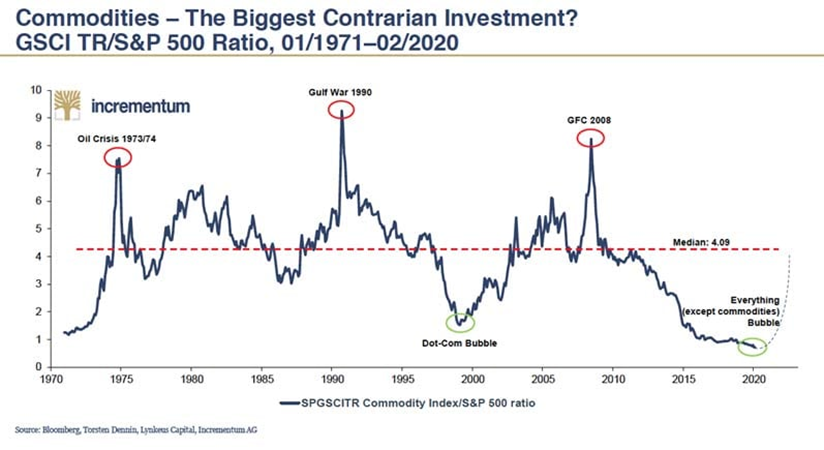

Commodities, in general, are in a highly bullish position, one not seen since the 1970s. Industry heavyweights like Goldman Sachs suggest that we could be on the cusp of a once-in-a-generation bull market for commodities.

The SPGSCITR Commodity Index during various crises. Source Incrementum.

In essence, 2023 could bring a supercycle – a decades-long surge in base material prices driven by an intrinsic shift in supply and demand. With growth unprepared for in 2023, this could be a prime time to diversify into commodities, especially gold.

But why is that? To answer that, we need to examine the current state of commodity markets. Over the past year, these markets have experienced a rapid increase in the cost of capital, which has reduced incentives to hold physical inventories or risk exposure.

As a result, inventories of nearly every primary commodity, including gold, have reached critically low levels. This scenario, as stated by Jeff Curie, the global head of commodities research at Goldman Sachs, is largely due to the fear of recession and the subsequent rise in the cost of capital that causes deleveraging.

While this scenario may seem grim, it’s precisely these circumstances that could lead to a boom in gold prices. With the decrease in liquidity and the depletion of inventories, gold and other commodities could see a sharp increase in price as demand begins to outstrip supply. As a critical point, the law of supply and demand would suggest that prices must go up when demand exceeds supply.

More encouraging still, Goldman Sachs predicts that a new capex cycle could begin in 2023. This cycle will depend on better relative returns drawing capital towards commodities, energy, and industrial firms, leading to more investment in the gold mining sector.

Gold vs Cash cost from 2022 to 2023. Source Incrementum

Given the drop in new economy valuations and the rise in commodity prices, we could see a shift in capital towards these sectors. As Goldman Sachs stated, “a three-year track record is crucial for persistent capex.”

Adding to the bullish case for gold, it’s noteworthy that gold miners have experienced record cash flows and cash reserves in the past two years. A strong performance in 2023 could solidify this bullish narrative and drive investor sentiment and fund flows toward gold.

In an economic environment with persistently high inflation, gold’s appeal as a store of value increases. As GlobalX ETFs noted, “gold’s biggest gains typically occur in the final stages of expansions.”

#4 Portfolio Diversification

Other investors could care less about the “religion of gold” and simply believe the historical evidence that adding gold to a portfolio decreases drawdowns during market crises and delivers improved returns.

Consider the recent collapse of Silicon Valley Bank on March 10, 2023. Ten days after this incident, gold prices crossed the $2,000/oz mark for the third time in less than three years. This reflects gold’s inherent capability to retain and even grow its value when other financial instruments falter.

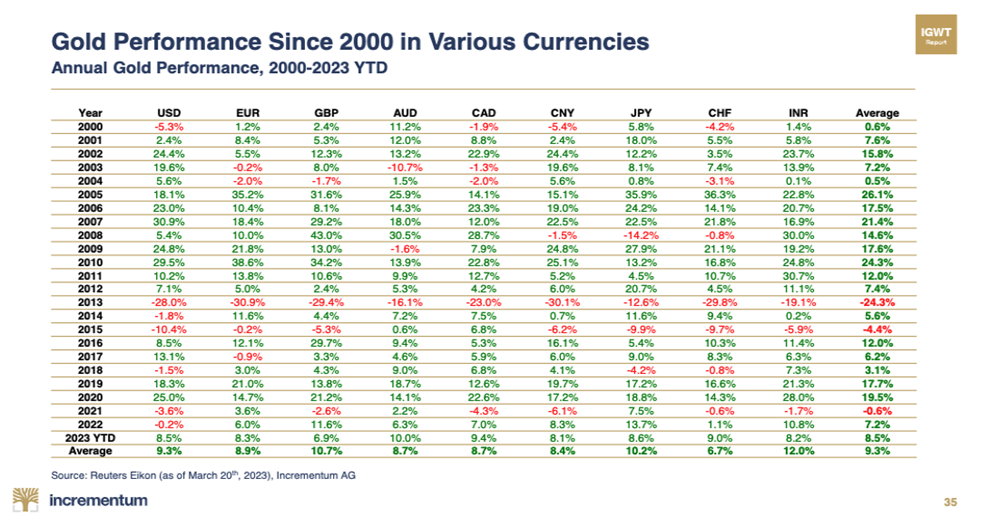

Not to mention that when inflation rises, currency values fall, leading to an erosion of purchasing power. Yet, gold’s value has historically held firm or even appreciated relative to major currencies.

Annual Gold performance, 2000-2023. Source Incrementum

This is due to the fact that during periods of stock market stress, a negative correlation can develop between gold and equities, making it an excellent tool for portfolio diversification.

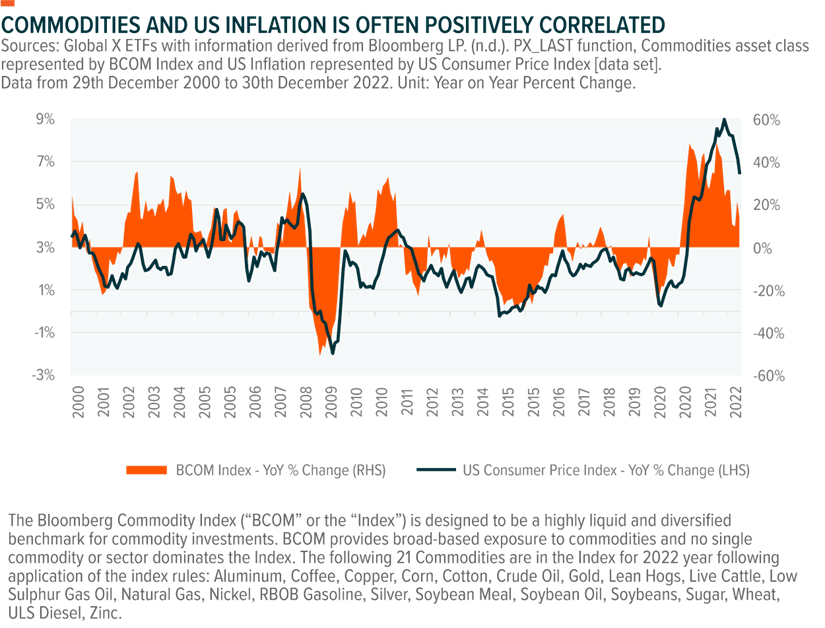

Correlation between commodities and US inflation. Source Bloomberg

#5 No Counterparty Risk

For investors who are concerned about yet another bank crisis, gold offers potentially the single most compelling value proposition of any asset; because gold has no counterparty risk – meaning, your asset is not someone else’s liability – it effectively exists outside of the banking system.

Gold has a rich history as a store of value, stretching back at least 3,000 years. This is significantly longer than any traditional currency, such as the British Pound Sterling, which is approximately 1,200 years old.

By reliably preserving wealth throughout generations, gold fulfills one of the essential promises of money – to serve as a long-term store of value. In fact, since 1900, gold has been outperforming many major currencies when it comes to maintaining purchasing power.

Gold’s stability and longevity become especially apparent when you look at its performance in times of economic crises or when the dollar falls. Unlike most other assets, which are essentially someone else’s liability, gold stands alone. This means there are no middlemen to rely on or contractual obligations to fulfill. Consequently, in times of economic bubbles or financial downturns, gold can act as a hedge, being the “last man standing” in an investment portfolio.

On top of that, gold’s inherent worth means it won’t drop to zero – a feat it’s managed to accomplish throughout its 3,000+ year history. It’s an asset you can always liquidate when you need currency. And if the Lindy Effect – which states that the older something is, the more likely it will be around in the future – is any indication… gold will continue to remain a reliable store of value.

Lastly, gold’s universal acceptance enhances its value as a global currency. It’s not tied to any specific country or government and is readily accepted across the globe.

#6 Asset Protection

Want to keep your gold away from the sticky fingers of the US government? Thanks to this loophole in the IRS’s Foreign Account Tax Compliance Act (FACTA) requirements, US citizens do not have to report foreign holdings for physical precious metals. Here’s why.

Essentially, the IRS is focused on the reporting of offshore structures like corporations, trusts, and foundations. If you’re holding an asset within these entities, it must be declared. But if it’s held in your personal name, certain assets are exempt from this stringent reporting requirement.

Assets such as physical foreign currency, tangible assets like art or jewelry, foreign-owned real estate, and notably, precious metals like gold and silver, can bypass these reporting rules if they’re held in your personal name. This essentially means that if you have physical gold kept in a secure location offshore, such as in a private vault, you’re not required to report it to the IRS.

This information comes directly from the IRS Q&A for Form 8938. The exclusion, however, only applies if the physical gold is not held in a bank or brokerage account. So, if you have a golden treasure chest tucked away somewhere offshore, Uncle Sam doesn’t necessarily need to know about it.

This loophole is indeed an interesting way to add an extra layer of privacy to your financial affairs, especially given the ever-expanding reach of the U.S. government and the FATCA regulations.

#7 Golden Barbell Strategy

For investors who are familiar with Nassim Taleb’s barbell strategy, gold can play a significant role in the “hyper-conservative” side of your portfolio. This strategy involves balancing 90% of your investment in safe assets and directing 10% towards highly speculative ones. Gold fits well within the 90% segment due to its enduring value and relative stability compared to riskier assets.

Traditionally, gold has been perceived as a “safe-haven” asset, much like cash, because it’s seen as a store of value that’s resistant to inflation. Its price may fluctuate in the short term, but historically, it has maintained its value over the long run. This makes it an attractive option for the conservative portion of the barbell strategy, providing stability and relative security. In essence, gold plays a similar role to cash in buffering your portfolio against potential market downturns.

Nassim Taleb’s Barbell Strategy

#8 Universal Liquidity and Convertablity

The liquidity of gold – the ease with which you can convert it into cash – is one of the main factors that make it an attractive asset.

Practically any jewelry dealer or coin shop in the world recognizes gold and is ready to buy it. Pawn shops, private parties, or even online dealers stand as potential gold purchasers, which significantly broadens the market for this precious metal.

Not all tangible assets share gold’s advantage of easy liquidity. Consider collectables like artwork: selling these can often be a long-drawn process, attracting large commissions and limited to a niche customer base. Gold, on the other hand, can be converted into cash or traded for goods virtually on the spot. There are simply fewer hoops to jump through.

Furthermore, the portability of gold enhances its liquidity. Gold can be carried discreetly, and even across borders if necessary. And if the need arises, gold can be quickly and conveniently melted down to trade in any form.

An additional factor that bolsters gold’s liquidity is its longevity. Unlike resources like oil, gold doesn’t degrade or corrode and doesn’t require special storage conditions. This makes it easy to store and maintain, ensuring it retains its value over time.

And since gold can be stored in small amounts, it’s a suitable investment choice for those who want to deal in smaller quantities. This is another aspect of its liquidity: the smaller the unit of the asset, the easier it is to sell it.

#9 Estate Planning

Gold has been a reliable source of wealth preservation for families and governments for centuries. Its universal value, scarce supply, and unique non-corrosive attributes make it an ideal store of wealth, acting as a safeguard against inflation, economic instability, and currency devaluation.

Families can even employ the “Buy, Borrow, and Die” estate planning strategy to pass on wealth, minimize taxes and maintain control over assets.

Ways to use the Buy, Borrow, Die strategy

Here’s what that process looks like:

1) Buy:

Gold can be purchased and held as a physical asset or via financial instruments such as ETFs, gold bonds, or shares in gold mining companies.

2) Borrow:

Rather than selling gold and potentially incurring capital gains taxes, borrowing against gold allows for tax-free access to wealth. For example, if you hold gold worth $1 million, you could potentially borrow up to 80% of its value (i.e., $800,000) at a relatively low interest rate.

3) Die:

In terms of estate planning, holding onto gold until death allows heirs to receive the gold at a “stepped-up basis”. This means the asset’s value for tax purposes is its value at the time of the holder’s death—not when it was originally purchased.

So, if you bought gold at $1,000 an ounce and it’s worth $2,000 an ounce when you pass, your heirs’ basis is $2,000. Any capital gains taxes would only apply to the increase in value from that $2,000 mark, allowing for significant tax savings.

#10 Doomsday Planning:

Last but not least, if you think that you’ll be in a “post-apocalyptic” scenario – either from natural disasters, war, or other events that force rapid relocation – precious metals are a convenient way to move your wealth (and have it be instantly usable in any other economy you land in). There are a few reasons for this:

First, precious metals hold intrinsic value, which essentially means they’re universally recognized as valuable. You can take a gold coin to nearly any place in the world, and it’s likely to be accepted or can be traded for local currency, goods, or services.

Secondly, they’re highly portable. Consider that as of 2023, gold is priced at around $2,000 per ounce. That means, in practical terms, you could fit $100,000 worth of gold in a small bag or a secure belt pouch, allowing for easy transportation in the event of a rapid relocation.

Thirdly, metals are durable and non-perishable, unlike paper money or other assets. They won’t rot or rust, and they can’t be wiped out by a computer glitch or a grid failure, unlike digital assets. This durability also adds to their universal acceptability as a form of value.

Finally, these metals are divisible without losing their value. If you have a gold bar worth $100,000, you could divide it into smaller bars or coins, each retaining their proportional value. This isn’t the case with many other tangible assets, like real estate or artwork, which can lose their value if divided or damaged.

The Best Ways to Invest in Gold?

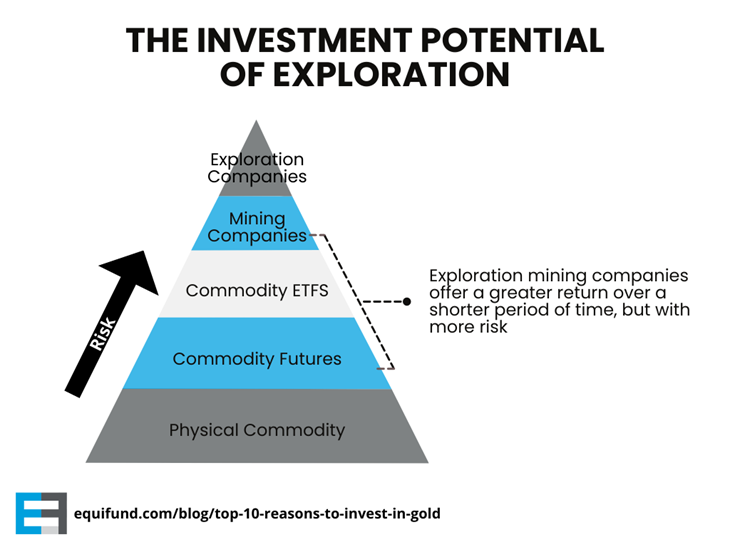

If you’re intrigued by the potential surge in the value of gold over the next decade, you’re likely deliberating the best ways to leverage this prospective trend. There are various routes for gaining exposure to gold, each offering different levels of risk and potential return.

The most direct method for investing in gold is by purchasing physical precious metals in the form of gold coins or gold bars. You can even opt to place your physical gold inside a tax-advantaged retirement account, known as the Gold Individual Retirement Account (IRA).

Alternatively, you can also make paper investments in gold indirectly via gold stocks and Exchange Traded Funds (ETFs) like SPDR Gold Shares (GLD). ETFs replicate the performance of the gold price, so when gold prices rise, so does the ETF. However, like holding physical gold, ETFs may not offer the high-return potential some investors seek.

If you’re looking to maximize your potential return, albeit with increased risk, investing in gold mining companies (particularly junior gold miners) could be an appealing route. These companies are engaged in the exploration and development of new gold sites.

The risk and reward of investing in gold mining companies

Want to learn more about investing in gold and private market deals?

Here at Equifund, we help investors access early-stage opportunities not found anywhere else. To view our current listings, go here now.

P.S. Equifund just launched its latest Regulation A+ offering for an already-publicly-traded gold royalty and streaming company.