On April 3, 2018, one of the most important moments in stock market history happened…

Spotify – the Swedish music streaming service – officially listed its shares on the NYSE using an unusual strategy.

No, it wasn’t via a special purpose acquisition company (SPAC) that’s all the rage right now (especially in the digital health sector)…

Instead, it was something that makes far too much sense once you understand how it works.

It’s called a direct listing (or “direct public offering” / DPO)

And its shocking success laid the groundwork for the first real challenge to Wall Street’s grip on their essentially “rigged” process of taking a company public.

Here’s why…

According to venture capital icon, Bull Gurly…

The traditional way of going public is systematically broken and is robbing Silicon Valley founders, employees, and investors of billions of dollars each year.

You see, the entire Wall Street business model is built on top of largely unnecessary fees that favor their “already-rich” clientele – NOT the Main Street investor looking to get in on the next big thing.

And nowhere is this more apparent than how shares are priced during a traditional public offering.

Have you ever asked yourself, who sets the price of the shares whenever a company goes public using an IPO or SPAC?

It’s not “the market” as one might logically expect.

Instead, it’s the institutional investors and big banks who underwrite the process (and charge huge fees for the privilege).

Here’s how it works…

In a normal IPO process, a company hires bankers to find investors to buy its stock. This is usually a pre-qualified group (i.e. institutions) who are willing to buy the shares before they trade publicly.

In practice, this means big investment banks – like Goldman Sachs – buy discounted shares from the company, and then pocket the difference when they sell shares to their client base at the IPO price.

Why is this a problem?

Because it results in underpricing of an IPO…

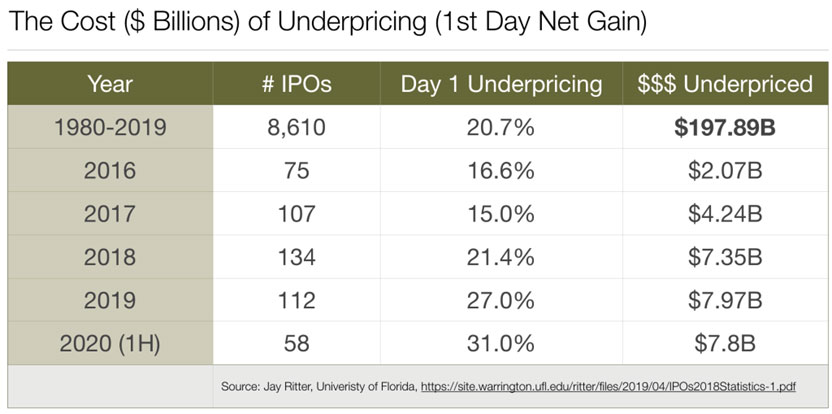

As you can see this problem is growing each year. The numbers from 2020 are truly astonishing. The average company that has gone public in 2020 was underpriced by 31%.

This equates to a cost of capital of 31% + 7% (IPO fees) = 38%! And the total dollars of one-day wealth transfer in just 6 months of 2020 was $7.8B. This is way worse than any given year prior in absolute dollars, but it has only been 6 months!

At this rate, 2020 IPO underpricing will transfer wealth of $15B in one day “give-aways” to Wall Street investment firms and their clients. Most of these companies are about 20% employee owned, so that is $3B right out of employees pockets.

So why do companies still go through with the process?

Well, to be fair, for a long time the IPO process made a lot of sense. Although annoying and expensive, it was the one of the only paths for a high-growth company to raise lots of capital, fast.

In fact, for pretty much the entire history of financial markets, banks have had nearly exclusive control over distribution channels – if you wanted access to this huge pool of capital, you had to go through them.

But this is starting to change…

Over the past 20 years, private companies have been staying private longer thanks to a growing trove of private dollars chasing early-stage companies.

It’s resulted in a not-so-secret war between Silicon Valley and Wall Street.

But until Spotify went public via direct listing, there hasn’t been anyone big enough – or bold enough – to challenge the IPO model.

And they were able to do it because of one simple reason…

They didn’t need to raise new capital by issuing new shares (which is what happens with an IPO).

“Having enjoyed great success in the private capital markets, Spotify had no immediate need for funding. So, with a large and diverse shareholder base, a well-known brand, global scale, a relatively easily understood business model, and a transparent company culture, Spotify felt that reimagining the process of going public through a direct listing was the path that best enabled it to achieve these goals.” – Marc D. Jaffe, Greg Rodgers, and Horacio Gutierrez, Latham & Watkins LLP [source]

You see, while direct listings are cheaper and are often more beneficial to existing shareholders in that there are no lockups periods, historically the challenge was that a company couldn’t raise funds via a Direct Listing.

However, thanks to a recent ruling by the SEC, this “no new shares” restriction is now a thing of the past.

The change “has the potential to transform the equity markets,” NYSE vice-chairman and CMO John Tuttle wrote on LinkedIn.

“This is really big,” Benchmark general partner Bill Gurley tweeted of the SEC’s decision. “We could get to a modern approach where Silicon Valley companies, founders, employees, and investors don’t have a 40% costs of capital to enter the public markets.”

With the change, a direct listing combined with a capital raise can present a company with something of a happy medium: go public and raise money, but save money on underwriters.

And for the rest of us, it could mean getting access to better opportunities in the public markets along with a new exit strategy that may provide liquidity for early investors, faster.

It’s still too early to tell if direct listing will have the same excitement SPACs are currently enjoying.

But in 2020…

- We saw Palantir and Asana both go public through the direct listing route…

- Coinbase – the famed cryptocurrency exchange – plans on going public via direct listing…

- Roblox – one of the hottest gaming companies in the world right now – also plans on pursuing the direct listing path…

- UiPath and Databricks became two of the most valuable privately held tech companies in the U.S. on last week, with massive new funding rounds that give them a combined valuation of more than $60 billion……and both of them are now considering a direct listing as well!

To say the least, we are wildly optimistic about this new path to going public.

We think it has potential to be a great mechanism for crowdfunded deals. And we expect a lot more companies to use this route in the future.

Sincerely,

Jake Hoffberg – Publisher

Equifund