While everyone else is talking about the landmark supreme court decisions to end affirmative action and strike down Biden’s student loan plan…

Here are the stories you haven’t heard much about.

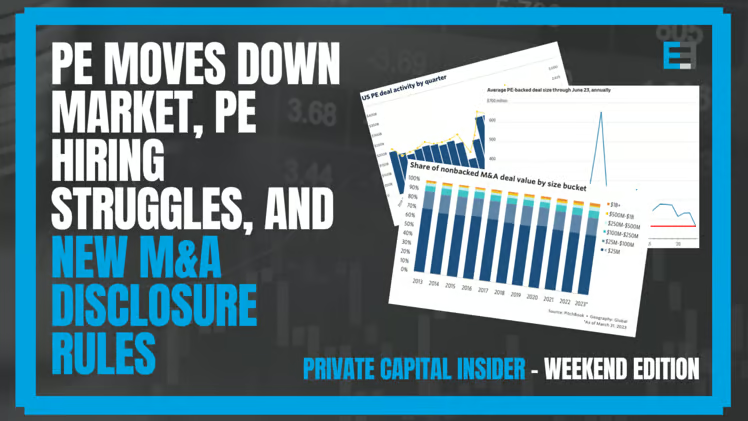

- Mega deals on pause as private equity dealmakers move down market

- PE backed firms are having problems hiring for key roles – especially CFOs

- FTC and DOJ propose new LP disclosure requirements that could further impact PE deals

Let’s dive in,

-Equifund Publishing

P.S. Due to the long holiday weekend, we’ll be taking a break from our WEEKDAY edition next week. Our next issue will be the July 8th weekend edition.

We wish all our Canadian and U.S. readers very happy and safe holiday celebrations.

Mega Deals on Pause as Private Equity Dealmakers Move Down Market

Now that the Era of Easy Money is over, buyout firms are using their ~$1.7 trillion of dry powder to snap up smaller companies.

Why? Higher costs of capital combined with uncertain market conditions, and sellers who likely wished they sold at 2021 prices but refuse to lower their expectations in the current environment.

According to Jeremy Swan, a managing principal in the financial-services and financial-sponsors group at advisory firm CohnReznick,

Smaller deals are just as hard, if not harder, to do than big deals. It’s a lot more challenging and requires more diligence.

But on the flip side, smaller takeovers and “add-on” deals often require zero debt, and allow firms to continue to deploy capital despite the tough market conditions.

Why? Because, in the Game of Private Capital, the Bankers understand how to use collateral and leverage to drive returns.

Most notably, using the balance sheet of existing portfolio companies to finance dealmaking – especially those that have existing debt facilities locked in at lower rates than are available today.

For this reason, the real story most people aren’t talking about is what types of businesses PE shops are buying…

And the “behind the scenes” rationale for why they buy them.

Remember: if you’re looking to improve returns in your portfolio, it’s better to reduce fee drag than it is to increase risk (which almost always means adding “leverage”).

When it comes to leveraged buyouts, massive amounts of debt financing are often a cornerstone of the strategy.

But here’s the thing about leverage. Mathematically speaking, the only time using debt produces better returns is if the asset can be purchased below net present value (NPV).

Otherwise, adding leverage only serves as a mechanism to compound fee drag, if you overpaid for the asset.

According to Ludovic Phalippou, author of Private Equity Laid Bare:

[Do investors] obtain a higher return on her equity investment if she borrows more? Most people answer yes, house owners should expect higher returns if they borrow more because that increases risk… But this answer is wrong!!

Right answer: it depends. It depends on how much [the investor] paid for the house.

People use leverage and debt interchangeably because they believe debt levers up (i.e., increases) returns.

However, debt increases your rate of return only if you buy something for too little, i.e., at a price that is less than NPV.

A financially literate seller won’t sell at £800k. Even if the current owner considers selling at £800k, competition will do the job: people will queue to buy the house at £800k, pushing the price up until it reaches £900k, which is the NPV, i.e., the fair price.

There will not be any arbitrage opportunity (i.e., free lunch), and therefore, leverage will not matter. It is the rule, not the exception.

Everyone has the same expected return, but the equity has become riskier: the spread in returns between the IN and OUT scenarios has increased.

Conclusion thus far: Even if there are taxes on corporate profits and interest payments are tax-deductible, and even if the future asset value is uncertain, leverage does not change the expected return of the private equity fund as long as the price paid is the fair price.

But remember. Bankers are masters of arbitrage and free lunches. Most notably, because they understand how to shift risk onto someone else.

What does this have to do with buying smaller companies? A lot, as it turns out.

According to a recent Pitchbook report, the hottest deals in the Private Equity M&A market are founder-led, non-backed private companies.

Why? Because it can be easier to effect change and “professionalize” a non-backed founder-led business, making it easier to extract growth.

These companies have no previous funding from sponsors or other outside capital sources, meaning the new PE or corporate owners can start from a clean slate without any baggage from prior owners and conflicting cultures (i.e., someone else already extracted all the Alpha leaving only Beta for the next buyer).

And overwhelmingly, these businesses are purchased for far lower multiples than their corporate-backed and sponsor-backed peers.

The vast majority (84.8%) of global M&A deals with no backing took place under $100 million in 2022.

Businesses bought for less than $100 million, have a much lower EV/EBITDA multiple than businesses in other size buckets.

In 2022, the median EV/EBITDA multiple for firms under $100 million was 6.8x, while the next size bucket ($100 million-$250 million) posted a median multiple of 11.4x—a 40.3% differential!

On the surface, there are a lot of reasons for why these smaller businesses command smaller multiples – namely, the future cash flows of smaller enterprises are, generally speaking, less certain than cash flows of larger enterprises.

But the real “trick” here is how Bankers engineer their free lunch with these add-ons and roll-up acquisitions…

The PE firm buys several smaller businesses at a ~7x multiple, and then combines them together in a way that cash flows are now large enough to be valued at an 11x multiple (called multiples arbitrage).

This means that with essentially no change to the business operations, just some financial engineering, they can instantly create more valuable collateral, of which they can borrow even more against.

To be clear, this isn’t to say that this strategy is some meritless Wall Street Cheat Code that produces no additional value (although that is true in some cases)…

Partnering with a skilled PE buyer or investor can pave the way for a much more orderly transition and successful outcome for all involved.

For example, sponsors may provide ample opportunities for acquired companies to tap into entire platforms and centers of expertise across all utility functions (sometimes called “portfolio services”).

But again, the devil is always in the details.

One of the ways PE firms will shift the risk back onto the selling founder is to tie pay to earn-outs and future performance – in many cases, also requiring that founders continue working in the business for the next 1-3 years, ensuring the asset performs and those targets are met.

This is something I’m predicting will become more common as PE-owned firms confront hiring hurdles for key roles.

Nearly half of private-equity fund managers and portfolio-company finance chiefs say private-equity-owned businesses are understaffed, including key finance positions, according to a recent survey.

Meeting growth expectations often requires adding business through acquisitions. But with the rise in rates and the sluggish rate of investment exits, 55% of CFOs at companies owned by larger private-equity firms said getting deals done has been a challenge.

In my opinion, what’s actually happening is that after a decade of wonky capital markets, an entire generation of professionals forgot how “real” finance works.

Now that we’re no longer in an environment with unlimited cheap money and easy arbitrage opportunities that come with it…

Generating outsized returns means going back to the fundamentals: increasing free cash flow through operational excellence and organic growth.

FTC may require PE funds to disclose LPs

For decades, private equity and venture capital firms have kept the names of their investors (called limited partners or LPs) a secret.

But that could all change now that the Federal Trade Commission (FTC) proposed a number of amendments to the Hart-Scott-Rodino or “HSR” form, requiring parties to disclose more details to the FTC and the Department of Justice ahead of larger mergers and acquisitions.

The Hart-Scott-Rodino Antitrust Improvements Act of 1976 (HSR Act) requires that parties to certain transactions submit premerger notification filings, known as HSR forms, to the Federal Trade Commission (FTC) and the Antitrust Division of the Department of Justice before the transaction can close.

- Provision of details about transaction rationale and details surrounding investment vehicles or corporate relationships

- Provision of information related to products or services in both horizontal products and services, and non-horizontal business relationships such as supply agreements

- Provision of projected revenue streams, transactional analyses, and internal documents describing market conditions, and structure of entities involved such as private equity investors

- Provision of details regarding previous acquisitions

- Disclosure of information that screens for labor market issues, by classifying employees based on current Standard Occupational Classification system categories

Currently, the HSR form only requires the disclosure of the general partners, and the identities of minority stakeholders in voting securities.

However, the proposed changes would treat funds like corporations, which require disclosing the identity of any minority investor with a stake of 5% or more.

According to Pitchbook

When the disclosure of stakeholders’ identities was implemented in 2011, the FTC understood limited partnerships as structures that didn’t exert control over the operations of the fund or the fund’s portfolio companies.

Therefore, it didn’t view the disclosure of LP identities as essential to the pre-merger review process, regulators wrote in the amendment proposal.

Now, after a decade, the FTC has shifted gears, stating in the proposal that it would be “inappropriate” to make generalizations about the role of investors in limited partnerships and that LPs’ identities are in fact critical to uncovering any antitrust violations.

Most likely, this LP disclosure requirement would add additional costs, as well as more time to complete a transaction.

Is this a good thing or a bad thing?

Who knows what would actually happen should these proposals get through…

But I, for one, am in favor of increased transparency and disclosure requirements – especially as asset managers continue to push into the retail channel with less sophisticated investors.