People love to invest in “what’s hot right now”…

But here’s the truth about “hot stocks” most retail investors don’t understand…

You – the little guy – are the exit strategy for the people who are already in the investment!

Thanks to the rise of un-regulated promoters and influencers, there’s never been more risk for inexperienced investors.

That’s why today, we’re going to talk about…

Why (And How) Speculative Bubbles Form

If you’ve ever wondered how people can continue to get sucked into what are – in hindsight – obviously scams and bubbles…

It all has to do with the completely irrational way humans behave in crowds.

According to Charles Macaky’s now legendary book, Extraordinary Popular Delusions and the Madness of Crowds, published in 1841…

“We find that whole communities suddenly fix their minds upon one object, and go mad in its pursuit; that millions of people become simultaneously impressed with one delusion, and run after it, till their attention is caught by some new folly more captivating than the first.”

To be fair, in early stage investing, there’s almost no way to avoid hype.

Founders and CEOs have to tell an exciting story about new technology – and the future of their company – in order to raise capital at an attractive price.

As we’ve covered in previous issues, the hype-cycle (and a decade of cheap capital) can create a self-fulfilling prophecy that seems to push asset values higher and higher.

But like all speculative bubbles, eventually it comes crashing down…

And in every bubble, the end result is almost always the same…

Insiders Win, Retail Loses.

Unfortunately, financial bubbles are an unavoidable reality in investing.

The best we can do is understand why they happen…

How we can attempt to get in early enough to profit from the trends…

And what to do when one of our investments goes through the normal “boom bust” cycle.

The secret? It all has to do with one of the most important theories in modern finance…

The Financial Instability Hypothesis

Hyman Philip Minsky (September 23, 1919 – October 24, 1996) was an American economist who provided, with his studies, a theory to explain the development of financial crises and bubbles which he attributed to the instability of the financial system.

His primary theory was something he called the “financial instability hypothesis;” financial markets are inherently unstable, periods of financial booms are followed by busts, and governmental intervention can delay but not eliminate crises.

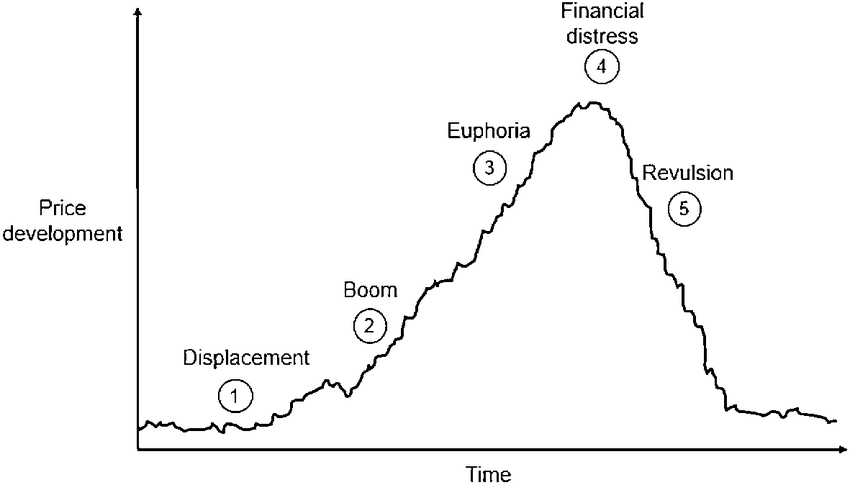

The original Minsky Model can be summed up by this flow chart:

The end result is what is now referred to as The Minsky Moment – the tipping point when speculative activity reaches an extreme that is unsustainable, leading to rapid price deflation and unpreventable market collapse.

Charles Kindleberger – who wrote Manias, Panics, and Crashes in 1978 (now in it’s 7th edition) – built on top of Minsky’s work and popularized the 5-stage bubble model.

- Displacement:

Bubbles start with a displacement, some sort of a shock to the system.

This could be war, a major political change, deregulation, a technological innovation, a financial innovation or a shift in monetary policy.

The displacement creates a new opportunity in at least one sector of the economy…

And the key to spotting the “next big thing” early is to look for these displacements.

- Boom:

A boom begins as optimism grows. This creates a positive feedback loop as the price of the asset goes up… which then leads to greater consumption and investment, which leads to greater economic growth.

The boom is accelerated as borrowers become more willing to take on debt, and lenders become more willing to make riskier loans.

- Euphoria (Mania):

A boom transforms into euphoria as “rational exuberance morphs into irrational exuberance.”

Investors become convinced that the world has changed in ways that make basic arithmetic irrelevant…

And that current growth rates will continue infinitely into the future.

Some, especially industry insiders, realize that there is a bubble. However, there is still money to be made and they continue to participate, believing they can cash out before the bubble bursts.

This is only made worse as media coverage brings new speculators into the bubble in the hopes of “getting rich quick.”

As Kindleberger said in Manias, Panics and Crashes, “there is nothing as disturbing to one’s well-being and judgment as to see a friend get rich.”

And as more people take on more debt to fund their speculation, the bubble continues to grow.

At this stage, fraud becomes increasingly common as people search for new ways to “get in” on the action (although it typically is not exposed until later.)

- Distress:

At some point, something happens that shakes investor confidence.

People who financed their purchases with borrowed money become distressed sellers as the income on their assets drops below their interest payments.

- Panic (Revulsion):

Not everyone realizes that a crisis is unfolding at the same time. Insiders and institutional investors usually sell first.

Then, selling turns into outright panic as everyone tries to get out at the same time… causing asset values to collapse in price.

Levered companies increasingly go bankrupt as they can’t meet their interest payments.

Credit dries up, and the panic continues until a lender of last resort steps in… or prices bottom out and value investors start to buy.

Then, the whole process begins again… either in the same asset or somewhere else.

As the saying goes, “there’s always a bull market somewhere”…

But perhaps it’s more apt to say, “there’s always a speculative bubble forming somewhere.”

Your job as an investor is to recognize when this is happening… and have a plan for how you might capture the upside while protecting yourself from the downside.

Final Thoughts

If you plan on investing in speculative Pre-IPO investment opportunities, you have to take a different approach to investing than you might be used to.

Unlike publicly listed stocks that can be traded on a moment’s notice, early stage investments often require a long term hold – 3, 5, even 10+ years before you can exit.

For this reason, we think about Pre-IPO investing like a long-term options contract: some will expire worthless, some will generate modest returns, and a tiny few may have the potential for extraordinary gain.

However, this strategy is not for the faint of heart and risk averse. In order to set yourself up for long term success, you must rely on a process driven approach, not an emotionally driven one.

Want to see how we approach this at Equifund? Go here to watch our latest Investor Education webinar – Investing in Today’s Hottest Trends.

Sincerely,

Jake Hoffberg – Publisher

Equifund