Digital health companies continue to see $1B funding weeks… driven by mega deal after mega deal… all alongside a tsunami of exit activity via SPACs, IPOs, and M&A.

Amazon recently announced they’ve “signed multiple companies to its Amazon Care telehealth service and will need thousands of employees to scale the service”…

Apple recently announced that with the new iOS 15 update this fall, some iPhone users will be able to send data directly from their Health app to their doctors’ electronic medical records systems.

And bloggers, analysts, and others are all talking about “The New Era of Healthcare” that’s about to be unleashed here in America.

But there’s a major problem that’s preventing this vision from becoming a reality…

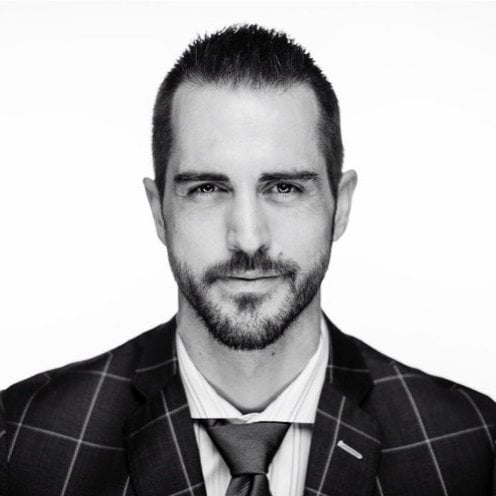

Between 2016 and 2030, chronic disease is projected to cost the U.S. $42 trillion…

The most disturbing part of this trend? As people age, the risk of chronic disease increases.

With 10,000 people turning 65 each day, so does the number of people with chronic conditions on Medicare…

Which, at the time of writing, 99% of Medicare spending is on behalf of beneficiaries with at least one chronic condition!

And the more chronic conditions they have, the more expensive they are to care for.

According to the RAND Corporation’s study, “Multiple Chronic Conditions in the United States”…

Those with five or more chronic conditions spend twice as much on average as those with three or four conditions…

And a whopping 14-times more than people with no chronic conditions!

What’s driving this massive increase in healthcare costs among patients with chronic conditions?

- Increased Length (And Cost) of Hospitalizations

Compared to those with zero or one chronic condition, acute condition stays are 11% longer for those with two or three chronic conditions… 21% longer when four or five conditions are present… and 27% longer when six or more conditions are present.

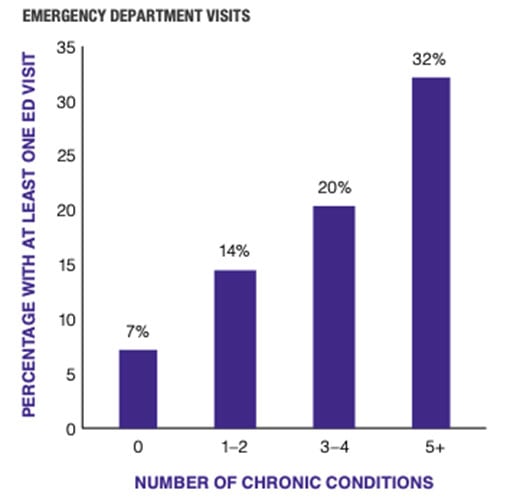

- More Emergency Room Visits

Nearly 60% of all emergency room visits involve people with chronic conditions, at a cost of $8.3 billion in 2017.

According to Premier Healthcare’s white paper “Ready, Risk, Reward: Improving Care for Patients With Chronic Conditions”, 27% of such visits could be prevented or treated in a lower-cost setting… saving an estimated at $2.5 billion each year.

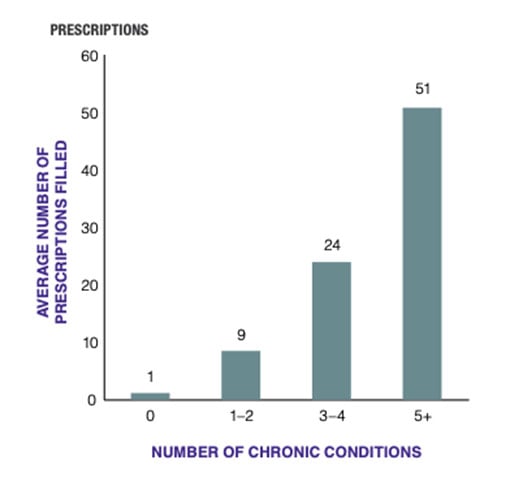

- Higher Prescription Medicine Costs

In 2014, people with no chronic conditions took an average of one prescription per year… people with 3-4 chronic conditions took 24… and those with 5 or more conditions used an average 51 prescriptions!

Drug Costs Are Skyrocketing!

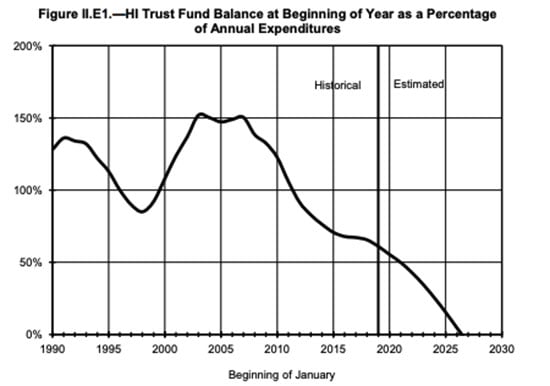

In healthcare, there is a strange paradox when you consider the impact of Moore’s Law in the technology sector…

In 1965, Gordon Moore – the CEO and co-founder of Intel – predicted the number of transistors on microchips would double every two years.

It’s effect? Double the computing power at half the cost.

However, in medicine, the opposite has taken place.

According to a 2012 study released by Nature Reviews Drug Discovery…

The past 60 years have seen huge advances in many of the scientific, technological and managerial factors that should tend to raise the efficiency of commercial drug research and development (R&D).

Yet the number of new drugs approved per billion US dollars spent on R&D has halved roughly every 9 years since 1950, falling around 80-fold in inflation-adjusted terms.

It’s called “Eroom’s Law” (which is Moore’s Law, but backwards).

Eroom’s law is the observation that drug discovery is becoming slower and more expensive over time, despite improvements in technology (such as high-throughput screening, biotechnology, combinatorial chemistry, and computational drug design), a trend first observed in the 1980s.

To make matters worse, the high costs associated with the higher number of prescriptions can lead to unfortunate results for patients…

In order to reduce costs, they won’t follow their doctor prescribed regimen (called “non-adherence”), which often worsens health outcomes and increases the likelihood of additional – and expensive – hospitalization.

If this trend continues, it likely means more people will be on more medication, at higher costs, for longer.

And the economic toll it’s taking on this country is devastating.

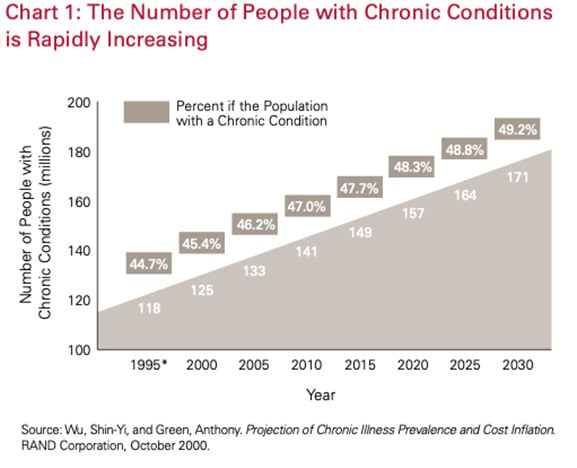

People are living longer, and living sicker… And the rising costs are driving Medicare into insolvency!

According to the 2020 Report of the Medicare Trustees, published on April 22, 2020…

Under the intermediate assumptions, the assets of the HI trust fund would steadily decrease as a percentage of annual expenditures throughout the short-range projection period, as illustrated in figure II.E1. The ratio declines until the fund is depleted in 2026, the same date as projected last year.

To avoid sounding alarmist, the Medicare Board of Trustees has been projecting insolvency dates since 1970, and we’ve been able to continue to push the projected insolvency date…

However, the implications are clear. This situation is not sustainable.

According to the Cato Institute

As Medicare grows relative to GDP, it will necessarily create some combination of crowding out of other government expenditures, rising taxes, and increasing debt.

At some point higher taxes will slow the economy and more debt will lead to higher interest rates, resulting in a vicious cycle of slower economic growth, exploding government debt, and perhaps even government default.

If we don’t do something to get control of chronic disease related expenses, it will not only speed up the likely chance of the Medicare Trust being depleted…

But will continue to deepen the already massive Federal Deficit.

However, Medicare is a “sacred cow” in America. Making budget cuts – or reducing coverage – would be potentially devastating for the tens of millions of people who rely on Medicare for their healthcare.

Which brings us to the $42 trillion question…

How can we make a huge – and ideally immediate – change in the health conditions of tens of million people on Medicare and reduce costs?

We must innovate!

And as investors who are looking to get a piece of the action… it means looking at things with open eyes, skeptical minds, compassionate hearts, and plenty of due diligence!

Any company can claim they’ve got an innovative solution that could “lower costs and improve patient outcomes”…

But there’s a lot of “tech bros” playing healthcare right now who simply aren’t prepared to deal with the difficulties of a heavily regulated industry.

Rather, the big winners are going to be those that combine new technologies with the backing of experienced medical teams and the technical expertise to navigate red tape.

For investors like us, these are the companies we should be on the lookout for.

Sincerely,

Jake Hoffberg – Publisher

Equifund